Dramatic days for Swiss private bankers: the plunging markets have wiped out huge amounts of money of rich people with leveraged investments. The massive destruction of assets is a consequence of a risky growth strategy – and of greed.

Margin Call! The many discussions that finews.com held with bankers and relationship managers at numerous banks and independent wealth managers over the past few turbulent days revealed a worrying picture.

A high-ranking banker put it in the following way: «Substantial amounts of wealth are disappearing. Client portfolios in double- or even three-digit million range crashed down to zero literally overnight.»

Rushing to the Exit

It is those assets that won't return even in any already eagerly anticipated recovery. They are gone for good – lost for the recently wealthy, but also for the banks and wealth managers.

There's no mercy in margin calls: once the market turns south, if you are leveraged your broker or wealth manager will call you up to remind you of your duty to provide more assets. Clients are forced to inject cash to prevent their portfolios from reaching a level of debt beyond a certain limit. The consequence: clients are required to sell, share prices drop even further, everybody is rushing for the exit and the markets crash.

The Perfect Example: the Demise of Martin Ebner

One who knows a thing or two about margins calls is Swiss investor Martin Ebner. He had built a huge stock portfolio in the 1980s and 1990s via his BZ Group Holding. The portfolio was worth as much as 30 billion Swiss francs ($30 billion).

But Ebner had put only little of his own money to work and gave banks his shares as security for more loans. When the dotcom-bubble burst, Ebner faced a meltdown. The value of the stocks he had in the deposits of the banks plunged and the banks sold the stock when Ebner didn't inject more cash. In the end, the investor had to drop almost all of his stakes.

A loan from his personal friend, Swiss right-wing politician Christoph Blocher, rescued Ebner after his empire's meltdown. Ebner then went on to achieve what others won't be able to emulate: return to fortune and become again a billionaire.

Not Really Irrational

John Maynard Keynes, the famous economist, who once had lost a lot of money on the stock exchange, concluded that markets remained irrational longer than you are liquid. Still, this year's crash that followed the margin call wasn't really irrational.

First of all, the corona-crisis is going to plunge the world economy into a recession and second, there was so much leverage in the markets that it is ran out of steam. The crash affected all markets: equities, corporate bonds, gold and even cryptocurrencies such as Bitcoin.

Trouble Brewing

The margin call has set alight the Swiss financial market. UBS CFO Kirt Gardner spoke of a jump in margin calls this week, but added that the losses remained limited. Credit Suisse CEO Thomas Gottstein soothed nerves on Thursday and suggested that his teams had lending under control.

Philipp Rickenbacher, the Julius Baer chief, last week agreed that margin calls took place. But behind the scenes, from Geneva to Zurich and Pictet to Julius Baer, the relationship managers were far more blunt: «We have made margin calls by the dozen.»

Greed With No End

The activities that aren't exclusive to Swiss banking, go to explain where all the liquidity went that central banks pumped into the system in recent years: for sure not to small- and medium-sized firms.

Instead, the money was given to the super-rich clientele of private banks in the shape of Lombard and other loans. Some bankers readily admit that the greed of some rich knows no end.

The Rich Got Richer – a Lot Richer

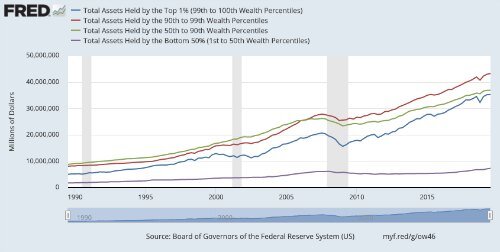

In November 2019 the U.S. Fed showed in a statistic that the wealth of the richest 1 percent of the world's largest economy had more than doubled since the financial crisis – while the Americans in the lower half of the population wealth-wise had seen their assets remain flat. This was the concentration of wealth in the hands of very few people that made it so lucrative for private bankers.

One part of the truth probably is also that the – in any case less-than-glamorous – development of Swiss banking since the crisis and the shift towards banking with taxed assets is owed to investment on credit.

Low Rates: Perfect for the Rich

The bitter irony in this: rich Swiss wealth-management clients were able to borrow more in an environment of ultra low interest rates to invest in equities and other markets, while savers and pensions funds suffered in the interest rate environment.

Iqbal Khan for instance made himself a name as a wealth-management star by using the beneficial environment to boost the lombard book at Credit Suisse and generate some of the best margins in the business. Credit Suisse isn't saying how large it lending book is.

The Sober Truth

At UBS, lending for the rich reached $180 Billion in 2019. With Khan at the top of the wealth-management unit, UBS, a rather conservative bank, planned to massively expand the book. Julius Baer had a lombard book worth some 40 billion francs at the end of last year. It also wants to boost this business along with assets under management.

Lending, and that's the sober truth in this, was what kept Swiss banking going as growth was elusive and margins crumbled. An hausse that lasted for a decade and low rates were drivers of this business model. The next round of half-year and full-year figures will show how sustainable the model of business was. It isn't simply the crash, but far more the margin call that has crimped the size of the bank's assets under management.