It hasn't come about yet, but the people working in the finance industry know it is an inevitability: wages have to come down. The coronacrisis seems to turn into something of a game changer, according to a survey among asset and wealth managers.

Analysts and consultants have seen it coming: the big drop in wages in banking and the financial market in general. But, so far, it hasn't materialized yet, because banks have been astute at maintaining their margins and value chains despite stronger regulation, higher compliance costs as well as more competition from fintechs and other providers of new services.

But the economic slump prompted by the pandemic has put the salary and bonus question back on the agenda of financial services companies: the managers of Spanish banks were among the first to proclaim a voluntary cut in pay and bonus, faced with the coronavirus crisis.

A Tentative Move

Swiss chief executives have been more reluctant in their approach. UBS is ready to forego paying cash bonuses if it can't deliver the second half of its dividend in the autumn. Credit Suisse also announced that the dividend would be paid in two installments, but it hasn't said anything on bonus payments for 2020 – and neither has Julius Baer, the private bank.

Proclaiming a voluntary waiver may make good sense from a strict compensation perspective: the first quarter was excellent for banks and a successful managing of the crisis could also be relevant for the bonus.

Help in Times of a Crisis

Banking software maker Temenos has given an example of how to forego on what you are due in favor of company and staff: CEO Max Chuard and Chairman Andreas Andreades on Tuesday pronounced that they would take a 50 percent remuneration cut after the company had to pull its guidance.

The sheer size of their cut is new – and proof for how the virus has set something in motion. A finding that is also supported by a survey conducted by Zurich-based headhunters Biermann Neff among asset managers and private bankers in Switzerland and Germany.

Sense of Contentment Despite the Crisis

The findings of the survey that have been made available to finews.com are a clear enough signal in uncertain times. They show an appreciation of how the coronacrisis will be the beginning of something new – and that's also why the fundamental sentiment among respondents is positive and optimistic.

The clearest indication of this comes in answers to the question how well the management of the companies deals with the crisis: 98 percent answered «very well». The answers to how the current atmosphere at their companies was best described corresponded to this: about half of respondents say «good», a third said «as usual», while only 2 percent proclaimed that the situation was «very bad».

Concern About the Future

And yet, despite the good marks for the management and the good atmosphere, the crisis has caught up with the asset and wealth management industry: about a fourth are concerned about the future of their firm.

Worries about a drop in revenues, loan defaults, job cuts and about the resilience of the business and the financial situation show clearly in the statements: «The survey findings show a strong attachment to the employer in the current situation – and in part also coupled with concern about the future of the firm,» said Jonas Neff (pictured above), partner at the executive search company.

Realistic Bonus Expectations

The survey also asked specific questions about the pay and bonus issue. Almost half of all respondents are ready to forego some of their salary if it helped the company. Asked about how much they would be ready to give up on, the survey participants said between 10 and 25 percent.

Klaus Biermann, the other partner at the firm (pictured above), sees a link between the readiness to accept a pay cut and the high approval ratings for the crisis management. «We see a new openness and readiness to dialogue about compensation,» Biermann said. «Staff are working as one and are more ready to make concessions to avoid job cuts.»

And therefore the expectations for their bonuses remain modest.

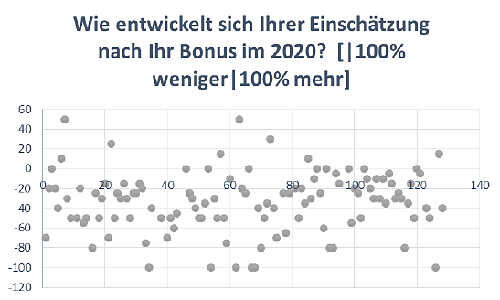

Expectations for the 2020 bonus: less than 100 percent and more than 100 percent respectively.

«The respective appreciation of ones bonus shows how many have accepted the true nature of the crisis and their readiness for concessions,» said Neff.

The Chance for the Reputation

Are the answers the result of a temporary sense of concern or is there a fundamental change underway? The respondents acknowledge in principal that a more permanent shift has begun, with 38 percent expecting major change, 50 percent forecasting slight and only 4 percent no change.

This perception of change is paired with their fundamental view that such change in principal is a good thing. «The readiness to forego is a chance for banks to restore their reputation,» said Biermann.