If we try to gauge the future of the economic crisis, we are on very thin ice; the development of the current first wave of infections, the uncertainty about a possible second (and even third) wave, and the hope and concern about the production of a vaccine – it all has an enormous influence on the future economic development.

This past week, the Swiss government tried to shed some light on the issues at stake. The economists advising the government expect a drop in the gross domestic product in 2020 of 6.7 percent and an average rate of unemployment of 3.9 percent. The slowdown would be the worst since 1975.

Signs of a Negative Spiral

Add to that a huge state deficit. Swiss Finance Minister Ueli Maurer told the eager public how much the government had already pledged to spend. At current count, the deficit of the Swiss federation will reach a staggering 30 to 40 billion francs. And that's excluding the 40 billion the government pledged to vouch for in emergency loans for companies, because these are meant to be paid back.

Can we deal with such a big deficit? Yes, of course we can. The current rate of indebtedness is relatively low after many years of surpluses and the rate that the state will have to pay for new debt will be minimal. But, all debt is to the detriment of future generations.

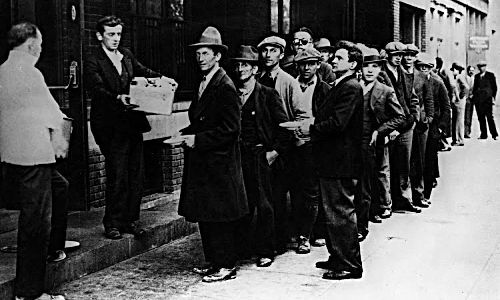

This week's forecasts were made at a time when most Swiss still hold a job – albeit more and more one subsidized by the government through emergency measures. The economic slump is global and even growth engine China's economy has contracted in the first quarter, the first drop in a very long time. This global slump is what makes economists suggest that we are heading for a great depression. Lockdowns, unemployment, drop in demand and consumption, higher public spending and taxes, lower profits. Such are the worries that one wonders how global stocks markets were able to recover a third of their first-quarter losses within two weeks in April.

A Big Headache for Tourism

Share prices evidently reflect the expectations for future earnings. In today's (hard) reality, we first have to contend with a collapse of the leisure industry and consumer goods spending. Our salaries will tend to decline on average and hence we will have less to spare for (not so important) consumer and luxury goods. Tourism will be hard hit by this, and air travel in particular.