The threat of job losses is coming into clearer focus as Switzerland tentatively emerges from pandemic lock-down. finews.com parses the specter of radical cuts.

Prior to the coronavirus pandemic, banking's priorities were pretty clear: invest in transforming digitally while cutting spending. The trends emerged last year in a study conducted by research firm Virtuosa, which polled 100 CEOs of banks globally.

As Switzerland eases restrictions imposed due to the outbreak, Swiss banks find themselves with the same set of priorities – but with dramatically more urgency. The two trends have advanced to the industry's imperative.

Digital Wake-Up Call

The lock-down phase, of course, forced banks and their clients to lean on digital tools, processes, products, and services. The order to shelter in place served as a digital wake-up call for lenders; traditional banks realized that the «digital customer experience» is more than a buzzword, but core to a client-centric strategy.

By contrast, finance start-ups view their technology as supported, and are determined to redouble their efforts to become either a viable competitor or an invaluable partner to established financial institutions. Coronavirus is a catalyst for a wave of digital transformation across the finance industry.

Forced to Cut Deeper

The second key factor is that the fallout from the looming, severe global recession will hit income at banks so hard that they will have little choice but to dramatically accelerate existing cost-cutting efforts. This can only mean: finance globally, including Switzerland's banking industry, is in for massive job cuts.

Just as with dramatic digital shifts, coronavirus will act as a catalyst for far deeper spending cuts in banking. Credit Suisse head Thomas Gottstein alluded to this in an interview this week, pointing specifically to increased automation at the Swiss bank as a reason for less staff in the mid-term.

Where Is the Revenue?

One of the biggest puzzles in traditional banking is why annual double-digit billion sums plowed into technology and digital transformation haven't yet resulted in much revenue for firms. They do, however, influence spending and staff numbers.

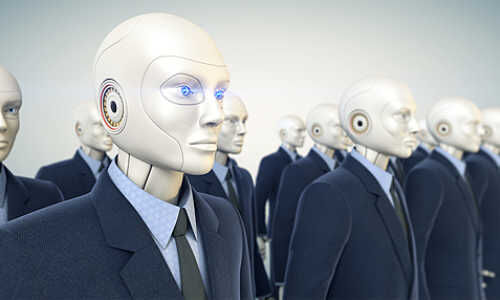

The continued absence of revenue from these efforts mean banks are coming under pressure from their investors to explain themselves, consulting firm Oliver Wyman wrote in a February study. Noticeably, bank CEOs have shifted tone to applauding the savings off tech spending: robots can replace staff for routine, repetitive tasks, for example.

Robots for Staff

Switzerland's bank employee lobby raised alarm early on: plans underway on the job market are comparable to the moon landing in 1969, head Lukas Gaehwiler warned last February. Meaning: at banks which are under pressure to transform, it is impossible to predict how their labor market needs will play out.

Other banks are less coy: UBS boss Sergio Ermotti said in 2017 that digitization would cost as many as 30 percent of UBS' jobs in the next ten years. U.S. lender Citigroup expects robots to replace as many as half its 20,000 technology and operations staff in the next five years. Applied to Switzerland's finance industry, that would mean of roughly 90,000 jobs currently, 60,000 will survive.

Corona Is the «Big Bang»

Tim Throsby, the former head of Barclays' business outside the U.K., said in 2018: «If your job involves a lot of keyboard hitting then you’re less likely to have a happy future.» Vaguely threatening two years ago – and a tangible risk for employees today. The frequently-predicted fourth industrial revolution has picked up enormous momentum through the coronavirus pandemic.

Ermotti, in his 2017 prediction, assumed technology would plod forward and manifest in steps – not as a «big bang». Thanks to the coronavirus, banks face a double–whammy: dramatically faster digital transformation than they planned, and a massive reduction in workforces.