Crosstown competitors UBS and Credit Suisse are being weighed up by rating agencies against the backdrop of the looming recession. The smaller Swiss bank emerges as the victor in some key points.

Zurich-based Credit Suisse has for years been touted as the riskier of Switzerland's two banking giants. After the financial crisis, Credit Suisse failed to shore up its capital quickly enough to keep pace with far stricter requirements imposed by regulators, waiting until 2015 to dramatically shrink its investment bank in a revamp under then-CEO Tidjane Thiam.

That was a full three years after UBS had already shifted its business model to focus on wealth management, abandoning riskier parts of investment banking, under CEO Sergio Ermotti. Rating agencies love UBS for fulfilling Basel III capital rules far earlier than Credit Suisse.

Better Outlook, Twice

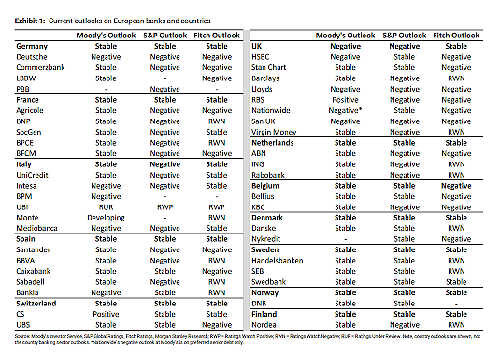

And yet, Credit Suisse's outlook is now viewed more favorably by all three major rating agencies – Moody's, Standard & Poors, and Fitch – than the supposedly sturdier UBS, as a report by Morgan Stanley highlights. Fitch recently left Credit Suisse's outlook to «stable,» while lowering UBS to «negative».

The overall difference in ratings is minimal: Fitch rates Credit Suisse at «A-» and UBS at «A+» – UBS is more favorably rated, meaning it can refinance more affordably on capital markets. The diverging outlook is important: it illustrates Fitch's view that Credit Suisse can weather the looming economic crisis more hardily than UBS will.

European Banks as Junk?

Morgan Stanley attempted to parse what effect the crisis would have on Europe's banking sector: the collapse of output in the euro-zone will send capital costs at banks surging, the U.S. bank's analysts noted – and ratings falling.

«Downgrades are bad news,» Morgan Stanley noted – especially for firms at risk of losing their investment-grade status. This would put their bonds out of reach for many institutional investors. Among lenders at risk are Spain's Caixabank, German LBBW, and Italy's Mediobanca, according to the brokerage.

UBS and CS are some distance from this fate – and the wider Swiss banking sector is rated«stable» despite the coming crisis.

More Potential for Profit

But Credit Suisse appears more stable. In December, Moody's awarded the bank the more favorable outlook – «positive» – vs. a «stable» mark for UBS. Credit Suisse possesses considerable potential to lift profitability following its three-year revamp, the agency argued. Fitch lifted the bank's outlook to «stable» from «negative» at the end of last month (and confirmed its March lowering of UBS' outlook to «negative»).

Credit Suisse has an ample enough cushion to withstand bigger shocks, Fitch argued, and will remain adequately profitable this year. Because only roughly one-third of wealthy client assets are invested in equity markets, volume and revenue is somewhat insulated from further shocks. Fitch pinpointed risks in Credit Suisse's oil and gas business as well as its extensive leveraged lending activities.

More Credit Exposure

At UBS, Fitch only sees about 0.8 percent of loans as imperiled, but the rating agency notes UBS has about $27 billion in corporate and small- and mid-sized business loans outstanding, as well as $30 billion in commercial real estate. Another $4.5 billion in at-risk credit adds to the load.

The forecasts put both UBS and Credit Suisse as «rock-solid» compared to their European counterparts – even in case of a double-digit contraction.