A Swiss NGO has looked into the reality of anti-money-laundering efforts of major financial markets. Switzerland and the U.S., two of the biggest markets, scored badly for similar reasons.

Switzerland, which is proud of its own standing in the world, has no reason to rejoice at the latest Basel AML Index, a measurement of the countries’ anti-money-laudering efforts: in the list of 141 countries, Switzerland can be in 93rd place. Estonia was top, Afghanistan last.

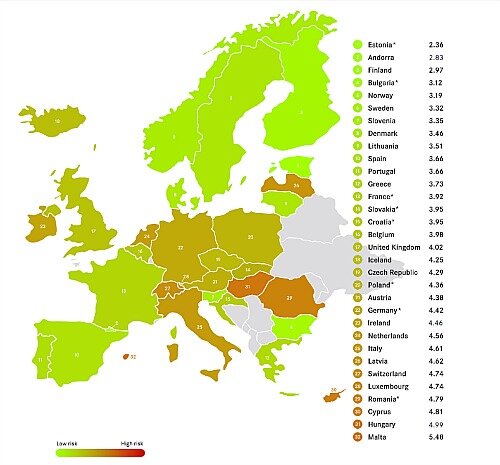

Looking at the European context, Switzerland’s decision-makers will take even less comfort from the index, ranking as a country in the risk-zone (see table below). Only Luxembourg, Rumania, Cyprus, Hungary and Malta fared worse.

Why the harsh reading? The index, compiled since 2012 by the Basel Institute on Governance, is based upon four different measurements. First, the effectiveness of the governments and companies’ fight against money laundering and terrorism. Second, the level of corruption. Furthermore, the index also is looking at transparency standards and legal and political risks.

Wirecard Weighs on German Reading

The Basel-based institute has used the data provided by the Financial Action Task Force (FATF), the World Bank and the World Economic Forum (WEF). The most recent compilation showed that money-laundering risks declined only slightly from a year ago. While six countries have improved on their 2019 readings, 35 countries fell back. The standing of Western Europe as a region was adversely affected by the scandal that surrounds German fintech Wirecard.

Switzerland once again was awarded negative points for its perceived lack of transparency. One example of the probes into activities of Swiss backs was the case against Julius Baer. At least Switzerland isn’t put into the category of major money-laundering hotspots such as Belgium, Cyprus, Malta, the Netherlands, Spain and the U.K.

Who’s Got Something to Hide?

One of the major centers of money laundering and less-than-transparent activities however is the U.S., say the authors of the study. The country is sharing the negative image in respect to transparency with Switzerland. Incidentally, it was the U.S. that hounded Swiss banks into giving up on certain business practices.

But the bad readings of the U.S. don’t come as a major surprise, given that the country doesn’t participate in the automatic exchange of information and OECD tax accord. Which helped tax havens such as Delaware to flourish where others foundered.