Credit Suisse is applying the reset button in investment banking and will merge two business segments. The team of CEO Thomas Gottstein is putting its faith in the banking with rich clients.

The markets and investment banking businesses will be merged into one – investment banking or simply IB. The aim of providing a single global platform is to create the critical size for both corporate and institutional clients. Credit Suisse will also create a Global Trading Solutions unit and a globally integrated equity trading, the company said in a statement on Thursday.

The new mega-division will be headed by Brian Chin (in the picture below), the erstwhile head of global markets. The U.S. American, 43, will increase his reach within the bank dramatically by taking on this new position.

Sustainability Push

Lara Warner, the head of risk, will take over as chief risk and compliance officer (CRCO), a hugely challenging position created to provide an effective controlling and improve coordination.

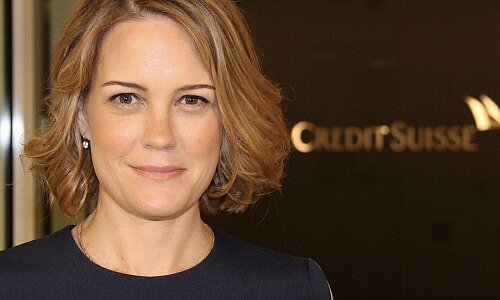

Lydie Hudson, (pictured below), the current head of compliance, will take promotion to the executive board and take over as head of sustainability, research and investment solutions. This will see a merger of expertise from investment solutions and products as well as research.

Credit Suisse aims to become a leading provider of sustainable products and generate some 300 billion Swiss francs for sustainable financing over a ten-year period. It will aim to move away from the oil- and gas-business.

Saving, While Growing

The restructuring has both savings as well as growth implications. CEO Thomas Gottstein aims to generate savings of about 400 million francs a year as of 2022.

The money will be reinvested in growth initiatives depending on the market conditions prevailing. The company didn’t mention any effects this may have on its staff.

Gottstein will spend on the Swiss Universal Bank (SUB), International Wealth Management (IWM) and in the Asia-Pacific region. He wants to maintain the investment banking expertise available at the Swiss and Asian divisions and improve the financing business, mergers and acquisitions and advisory within IWM. Credit Suisse aims to double revenue growth from ultra-high-net-worth clients within a three-year period.

Investment Banker Boosts Private Banking

Investment banker Gottstein aims to strengthen the wealth management at the company and will allocate two thirds of the bank’s capital to this unit in the medium term.

The Credit Suisse executive line-up as of August 1, 2020:

Thomas Gottstein: Chief Executive Officer

André Helfenstein: Swiss Universal Bank

Philipp Wehle: International Wealth Management

Helman Sitohang: Asia Pacific

Brian Chin: Investment Bank

David Mathers: Chief Financial Officer

James Walker: Chief Operating Officer

Lara Warner: Group Chief Risk & Compliance Officer

Romeo Cerutti: General Counsel

Antoinette Poschung: Human Resources

Lydie Hudson: Sustainability, Research & Investment Solutions