Digital applications at wealth managers are crude and lag even those of retail banks, a new study finds. No Swiss provider made it into the top-ten rankings, finews.com reports.

First-half results from Swiss wealth managers like Julius Baer, UBS, EFG, Vontobel and Credit Suisse show: the corona crash in March took a bite out of asset piles. The shortfall could only partly be made up with net new money – and clients are deeply insecure.

This represents a new normal, according to American bank Morgan Stanley and consulting firm Oliver Wyman, which in a joint «Global Wealth Management Report 2020» calculate that the wealth management industry is suffering a lost year of growth due to the pandemic. The wealthy's funds will shrink by an average four percent – and a recovery isn't expected before next year.

Slash, Buy, Digitize

This leaves private bankers without the still rosy growth prospects they had previously enjoyed. In the last decade, wealth managers could count on roughly eight percent growth in assets, according to the study's authors. Without this fillip, margin erosion as well as higher costs weigh heavier – the same effect that Swiss retail lenders long ago faced in their mortgage loan businesses.

The antidote? Cutting costs and consolidating, according to Morgan Stanley and Oliver Wyman. A third alternative is far less tested: stepping up digitization efforts. This, the study illustrates, is easier said than done going by current standards: existing applications leave much to be desired – especially those at Swiss wealth managers.

Corona Laid Groundwork

Clients or private banks and asset managers laid the groundwork: during March and April when commercial air travel was largely halted, digital communication channels boomed. Online interaction between banks and clients surged ten-fold, with three times as many virtual meetings via video conferencing than otherwise, according to the report.

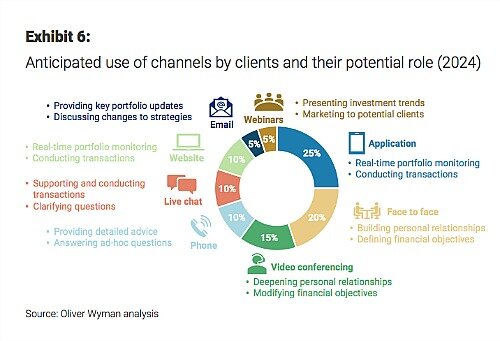

Born out of necessity, this so-called multi-channel access is taking hold, Morgan Stanley and Oliver Wyman note. By 2024, a personal and direct exchange between private banker and client will be the exception – roughly 20 percent of all contacts, is their forecast (graph below). This brings wealth applications in particular into sharper focus – but most solutions are crude in the authors' view, lagging even those offered by retail lenders.

Staying Up-To-Date

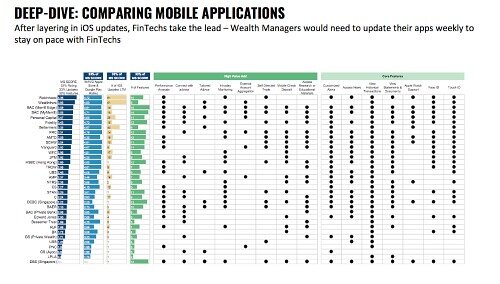

A ranking compiled by Morgan Stanley and Oliver Wyman illustrates the lag: of the 34 leading wealth managers examined for number of functions, frequency of updates, as well as client ratings in Google and Apple's app stores, American boutiques like Robinhood and Wealthfront led (graph below).

While that isn't surprising – both consider online asset management their core business – the lack of leading Swiss houses in the ranking is alarming. UBS, the world's largest private bank, misses the top-ten by a wide margin, in 16th place. Credit Suisse edges into the top-20 at 19th, while Julius Baer takes 23rd place.

A fintech arms race isn't necessarily the panacea to their problems either: a top app alone is nice to have, the study's authors argue, but isn't going to sway a potential client either way. Instead, wealth managers must decide in which instruments and areas they invest in. And because funds for growth are limited, only a fraction of the wish-list can be fulfilled. Time will tell who was astute in their decision-making.