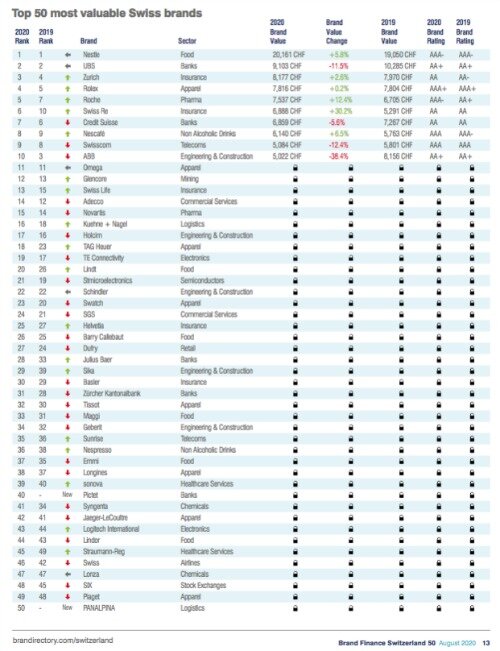

The corona pandemic dented the market value of countless Swiss brands, while banks and insurers appear to be using the crisis to burnish their images.

$16.5 billion: that's the damage the coronavirus wrought on Switzerland's most valuable brands, according to a study compiled by London-based brand specialist Brand Finance. The worst-hit companies included industrial firm ABB, agrochemical company Syngenta, and national airline Swiss.

Ironically, financial brands were some of the biggest gainers during the crisis: Julius Baer's brand value advanced nearly 49 percent on the year despite a massive sanction for an ugly money laundering scandal, while reinsurer Swiss Re and direct insurer Swiss Life won one-third and one-fifth, respectively.

The only big finance brand to lose in value was Credit Suisse, which has been mired in a tawdry spying scandal since September. By contrast, crosstown rival UBS and Switzerland's largest insurer, Zurich, took second and third place following food and beverage giant Nestle, which topped the chart (see graph).

The study doesn't elaborate on the specifics behind the advances. A $40 billion emergency loan bazooka shortly more than four months ago undoubtedly helped: UBS and Credit Suisse won plaudits for helping get billions in government back-stopped funding out the door and to small- and mid-sized businesses.

Longer-Term Damage

Portraying themselves as helpers in a crisis represents a huge opportunity for banks, which are still suffering the reputational fallout from the 2008/09 financial crisis. Swiss banks also drew funds from abroad during the crisis, spurred by Switzerland's reputation as a bastion of safety and stability.

The industry should grab the opportunity with both hands, Brand Finance said: the coronavirus crisis will hit global finance especially hard. The consulting firm predicts a 20 percent drop in brand value for banks and insurers further out as a result of the crisis.