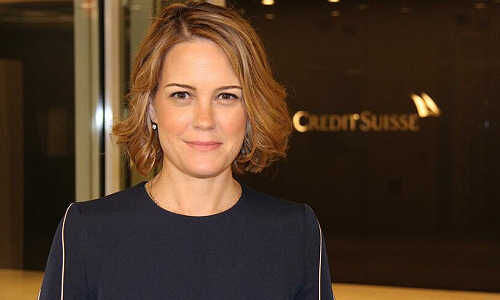

The perception of Credit Suisse has not yet matched its effort to become more sustainable. With the appointment of Lydie Hudson, the bank is now hoping to turn this around for good.

When Credit Suisse in July presented a huge half-year profit and announced a makeover of its investment bank, another piece of information got scant attention: Switzerland’s second-largest bank created a new unit called «Sustainability, Research & Investment Solutions» and appointed Lydie Hudson as its head.

The American, the youngest member of the bank's executive board, is now CEO, a title otherwise only awarded to the heads of division – apart from the group CEO. CEOs are typically expected to generate money for the bank.

Improving Its Reputation

As head of sustainability, research and investment solutions, Hudson has a function that is corporate, much like the CFO or head of risk. Hudson’s promotion and the decision by Credit Suisse to give sustainability such a strong institutional role at the top of the organization is quite remarkable. finews.com isn’t aware of a bank of similar importance and size with a sustainability executive who is a member of the top management board.

Not even at UBS, which has a better reputation in sustainability and corporate social responsibility than Credit Suisse. UBS appointed Huw van Steenis in 2019, a prominent name in the business and now a figurehead at Switzerland’s biggest bank. The British expert and star-analyst is head of investor relations and chair of the sustainable finance committee.

Hudson’s position and duties however serve the clear goal of helping Credit Suisse get rid of its tarnished reputation as a bank that finances climate change.

CIO Reports to Hudson

This would make Hudson a figurehead too of course, but the job that she has to fulfill is pretty clearly defined: the American is responsible for the sustainability strategy and its implementation across four divisions, plus the design of products, services and solutions as well as marketing.

Chief Investment Officer Michael Stroebaek will no longer report to Philipp Wehle, the head of wealth management, but to Hudson. And Marisa Drew, who as chief sustainability officer had first reported to CEO Tidjane Thiam and, starting in February 2020, to Thomas Gottstein, will report to Hudson.

Many details of the bank’s new sustainability strategy are still in the works. But the bank clearly aims to take the lead in its industry and make some 300 billion Swiss francs ($330 billion) available for sustainable investments over a ten-year period.

Big Exposure to Oil and Gas

The figure of 300 billion is big money. After all, the bank has so far not left a major impression in the field of sustainable investments – even though it was a major force behind sustainable energy production in Switzerland. But in general, the bank had been held accountable for its comparatively high exposure to fossil fuels.

As such, the bank became the target for environmental activists and studies ordered by Greenpeace and Amazon Watch denounced Credit Suisse as a bank still heavily exposed to the oil and gas industries.

So far, Credit Suisse was left claiming dedication to responsible corporate governance and highlighting its push to introduce more sustainable investments when confronted by the generally well-founded accusations from environmentalists. But its claim to sustainability was always tarnished given the bank’s strong exposure to fossil fuels and gave the bank a bad name in terms of ESG standards.

Measures Introduced During the Reign of Thiam

It was former CEO Thiam who got concerned about the discrepancy between the bank’s image and the way it defined itself and who took the initiative to change this. He signed the Poseidon Principles, which proclaim the goal of cutting the pollution caused by shipping. He also oversaw the decision to exit the financing of coal-fired power stations.

Thiam had appointed Drew in 2017 as head of impact advisory and finance (IAF), which created investment solutions with a social return for wealthy clients and institutional investors.

Drew subsequently moved her business toward ESG investments and designed the plan to make the bank’s asset management more sustainable.

Credit Suisse Opts for Transparency

Thiam’s push had been well met among his colleagues on the executive board and his successor, Gottstein, is now putting pen to paper, implementing what was in the planning for a while.

It will fall to Hudson to steer Credit Suisse out of the traditional business which gave it such a bad name, to make the bank more transparent and give it a new, greener image.