How did investors deal with risk during the corona crisis? A recent study uncovers some surprising answers to this question, LGT's Eline Hauser writes.

Investors tended to be cautious during the first phase of the corona crisis between mid-February and mid-March. They tried to reduce risk, and 36 percent of those who made changes to their portfolios increased their cash holdings.

However, the situation was quite different from mid-March onwards, by which time 49 percent of respondents had reduced their share of cash and invested boldly in what was still an uncertain stock market situation.

Risk Assessment Remains Stable Over the Years

To date, the behavior of investors during the corona crisis shows that even severe market volatility has only a short-term impact on private banking clients’ attitude towards risk. In other words, it does not throw investors completely off track.

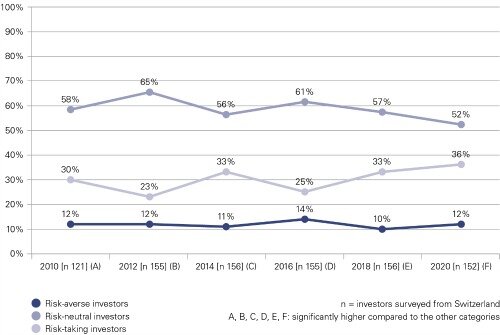

This fact has been consistent over the years, as LGT's study (in German only) shows: the share of investors who classify themselves as risk-averse has remained virtually unchanged at 10 percent between the 2010 to 2020 observation period. The share of risk-takers varies to a somewhat greater degree (between 52 and 65 percent) – and is linked to the respective stock market performance (see figure 1 below).

Change in Risk Attitude – Proportion of Risk Tolerance

The proportion of risk-averse individuals remains virtually unchanged over the ten-year period under consideration, while the proportion of risk-takers fluctuates over the years.

«During periods of weaker stock markets, some risk-takers tend to describe themselves as risk-neutral, but do not switch over to the risk-averse category,» explains Professor Teodoro D. Cocca, who led the study.

According to Heinrich Henckel, CEO LGT Bank Switzerland, this makes sense: «It’s good if investors don’t have to adjust their strategy in the event of short-term crises. That is the goal of a strategy that is geared towards optimizing returns over the long term, such as the one we pursue at LGT. This way, clients can remain true to their investment strategy even during riskier times.»

Investors’ assessment of the risks associated with various asset classes has also remained stable. Hedge funds and derivatives are perceived as the riskiest asset classes, followed by shares in foreign companies and private equity.

Shares in domestic companies, investment funds and commodities/gold/other precious metals are rated as less risky in comparison. The risk assessments of private banking clients are even lower when it comes to bonds or financial products that invest in real estate. Investors are least concerned about cash.

Home Bias Among Risk-Averse Individuals

When comparing assessments of the risk associated with different asset classes, it is interesting to note that shares in foreign companies are considered significantly more risky than domestic shares. The so-called home bias plays a role here.

As the study shows, the bias is stronger among risk-averse investors with a relatively low level of financial literacy – often women – than among investors with a high-risk tolerance and level of financial literacy – often men.

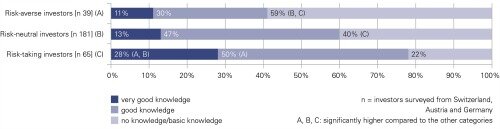

When it comes to the question of how investors classify themselves in terms of their willingness to take risks, a striking difference between genders can be identified: at 28 percent, men are significantly more likely to say they are willing to take risks than women at seven percent. This goes hand in hand with another finding: investors who rate their level of financial literacy as high are more willing to take risks than those who rate their level of knowledge lower (see figure 2 below).

Financial Literacy and Risk-Taking

28 percent of risk-taking investors say they have a high level of financial literacy. In contrast, 59 percent of risk-averse investors say they have no knowledge or only basic knowledge of financial issues.

Women rate their level of knowledge significantly lower than men, with 72 percent saying they have no or only basic knowledge, compared with just 36 percent of men. «It’s important not to underestimate women because they are more modest about their level of financial literacy than men. The same applies for risk aversion – a satisfactory long-term return can also be achieved with a lower amount of risk in the portfolio,» Henckel says.

Does Attitude Towards Risk Determine Expected Returns?

Risk aversion is high among women, regardless of the size of their assets, whether or not they are solely responsible for money matters, or whether they make investment decisions themselves or delegate them. Even female entrepreneurs are only slightly less risk-averse than women who are not entrepreneurs.

The findings are the opposite for male respondents. Their propensity to take risk drops from 33 to 22 percent when they share responsibility for assets with someone else. Thirty-five percent of male investors who make their own investment decisions say they are risk-takers, by far the highest figure when compared with the other investor types, such as delegators. And among male entrepreneurs, the share of risk-takers is slightly higher than among men without entrepreneurial experience at 33 percent.

In Favor of Women

And what do the risk-takers gain from their attitude? They differ from the risk-averse by having a lower share of cash (21 vs. 50 percent) and bonds (9 vs. 16 percent), and a higher share of equities (69 vs. 45 percent) in their portfolio. In 2019, for example, this paid off due to market dynamics.

In terms of returns, men have a slight advantage (median 10.26) over women (median 9.79). However, since risk-averse women are significantly less invested in equities than men (32 vs. 40 percent), the picture here changes again somewhat in favor of women.

Eline Hauser is a marketing manager at LGT

As part of the LGT Private Banking Report, the Department of Asset Management at Johannes Kepler University in Linz, under the leadership of Professor Teodoro D. Cocca, in January/February 2020 conducted the sixth survey since 2010 on the investment behavior of private banking clients in Germany, Austria and Switzerland. A total of 358 individuals were surveyed. The main criterion for participation in the survey was disposable investment capital. In Germany and Austria, the minimum disposable investment capital was 500'000 euros and for Switzerland, it was 900'000 Swiss francs. Due to the effects of the corona pandemic on financial markets, a follow-up survey was conducted in April 2020 with the private banking clients in Switzerland who had already been surveyed in January by the LINK Institute.