The aftermath of a major money laundering scandal at ING threatens the Dutch bank's former boss, Ralph Hamers, now at UBS. Holland's prosecutor was ordered to revive a probe into the executive – a move which may have serious consequences for Hamers.

If UBS' board arrives at the conclusion that Hamers' legacy is a burden and prevents him from giving the Swiss bank his full attention, his tenure in Zurich is likely to be cut short.

7. UBS: Showdown in Paris

The Swiss bank's second go in Paris – a June 2020 appeal was postponed due to the pandemic – begins in March. The trial revives and seeks to overturn a 2018 conviction for tax fraud and money laundering.

After tweaking its defense strategy, boosting its legal team, and enlisting ex-political heavyweights, UBS is set to go. The Swiss bank suffered a painful $5 billion defeat in the case in 2018 – a decision it is convinced it can overturn on appeal.

8. Sustainability: Where There's Smoke, There's Fire

The pandemic provided a fillip to environmental and impact concerns – which translates to finance, where the conversion to sustainable products is well underway. The Swiss Sustainable Finance lobby counts 160 members and network partners, while banks including Credit Suisse are placing the topic front and center of strategy.

By contrast, Switzerland's central bank has been slower, dragging its feet on distancing itself from coal investments under pressure only. That won't let up anytime soon: the Swiss left-wing party SP is trying to corral Swiss banks into a «green money» strategy, which already has several institutes up in arms.

9. Spygate Sticks At Credit Suisse

A covert surveillance operation of a top executive surfaced 16 months ago – and is still not over yet for Credit Suisse. Regulator Finma ordered an outside investigation, and in September flagged enforcement proceedings.

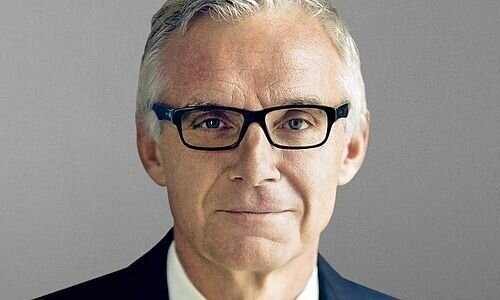

The overseer is looking at questions of how the spying was ordered, documented, and monitored. Zurich's prosecutor is also investigating, and the matter is certain to resurface again in April, when long-standing Chairman Urs Rohner (pictured above) steps down due to term limits.

10. Tweaking Occupational Schemes

Swiss pension reforms are set to hit parliament in the first half of 2021 – the last chance to temper the system to the reality of a long-term low interest rate environment. The reforms aim to ensure pensions, strengthen their financing, and improve coverage for part-time workers.

Once again, the reforms rely on additional contributions from younger employees, which has until now blocked the renewal of occupational schemes. The pandemic underscores the urgency of reforms – while financial services struggle to provide returns in the current environment.

11. Libor: Nightmare Ending?

The race to replace the benchmark reference rate, tainted when it emerged that banks colluded to rig it, with Saron is on: Finma took the issue onto its annual risk monitor in November, urging banks to convert quickly.

The volume of Libor-based financial products actually rose until mid-2020. Meanwhile, Britain flagged tougher scrutiny for its banks if they don't line up for new financial contracts by year-end – Swiss lenders would also need to be moved over by then. Crucially, converting from Libor-based contracts to Saron ones may mean legal risks which are difficult to assess.

- << Back

- Page 2 of 2