Credit Suisse is cracking down on the fund business. But over the past few years, private banking has channeled billions of assets into CS funds. Will the super-rich clientele of the big bank become a victim of the Greensill debacle?

On December 15 last year, there was a mood of optimism in the fund business of Credit Suisse (CS). At that time, Eric Varvel (pictured below), the head of asset management, appeared before the big bank's investors. The American provided information on the strategic review of his division and where he intended to focus in the future.

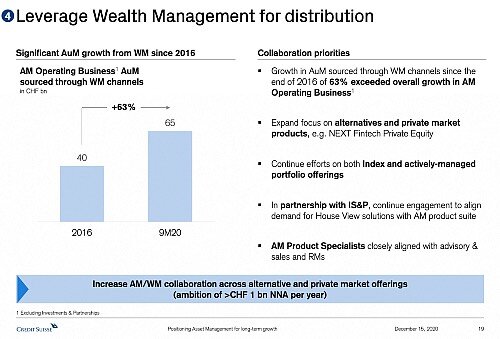

Varvel had in mind, for example, to strengthen the internal distribution of CS funds to private banking and to draw at least 1 billion Swiss francs ($1.08 billion) in new money from this cooperation – per year.

Ulrich Koerner Is Back

Since (yesterday) Thursday, everything is different at the CS Asset Management, starting with Varvel himself. As also reported by finews.com, veteran banker Ulrich Koerner is taking over for him with immediate effect. As of April 1, the fund business will be spun off from its previous place as a subdivision of CS International Asset Management (IWM) and will henceforth be run as an independent division. Further changes are not likely to be long in coming under Koerner's strict supervision.

This is owed to the debacle and the Supply Chain Finance (SCF) funds. In early March, CS decided to close and wind down the four vessels, jointly run with Australian-British finance boutique Greensill Capital, with more than $10 billion in assets under management. The bank's decision has since trailed Greensill's insolvency, drawing regulatory scrutiny and threats of lawsuits.

According to the CS annual report published Thursday, the Greensill debacle could now even weigh on the operating results of the entire group.

Broad Distribution

The consequences of the fund closures could be unpleasant for the very division from which CS Asset Management is saying goodbye: the IWM division under the leadership of Philipp Wehle (pictured below). Those familiar with the bank say that he has recently been less than pleased with the subdivision under his wing. This is probably not without reason: There are indications that substantial portions of the Greensill funds could have ended up in the portfolios of the super-rich clientele at IWM and at family offices.

Several people familiar with the Swiss wealth management scene interviewed by finews.com unanimously report that the SCF funds were distributed widely and with some effort by CS – to institutional investors such as pension funds, but also to other banks, wealthy private clients, and family offices, all of whom may be considered professional investors.

For Wealthy Investors

Apparently, however, Swiss pension funds, in particular, have rarely approached CS Greensill funds. «We have had a few inquiries from pension funds, but have always advised against buying the products,» says an adviser who wishes to remain unnamed. This coincides with the findings of «NZZ» (article behind paywall), which had also asked various well-known pension fund consultants about the Greensill funds. «It is more likely that the funds appealed to wealthy private investors,» says the adviser.

In turn, a local independent asset manager – who also remains anonymous – says he hears little from colleagues about positions in the CS Greensill funds.

Rapid Growth

CS does not disclose the origin of the approximately 1,000 investors with assets in the Greensill funds. However, it can be assumed that the lion's share of the fund units is held abroad, among others by wealthy private clients or family offices. Also among clients of Wehle's IWM?

The latter cannot be dismissed out of hand. Between 2016 and 2020, CS's private banking assets grew 63 percent, faster than the total client assets managed by asset management. Within five years, assets invested internally in CS funds climbed by 25 billion francs to 65 billion (see chart below). It is this inflow that Varvel promised to increase last December.

Potentially Damaging

Due to criteria such as the lack of daily liquidity, the funds did not end up in mandates of affluent clients of the big bank. However, it is likely that they will be used in customized «bespoke» mandates of the super-rich (UHNWI) clientele. On Thursday, CS already warned that certain investments of the blocked Greensill funds will not be repaid.

Likewise, the institution warned, the consequences of the fund closures could damage the company's reputation. As a result, CS did not rule out the loss of client relationships and the withdrawal of funds.

Stumbling Block

It's not there yet. But if the IWM division is heavily affected by such departures, not only its division head Wehle but also CS CEO Thomas Gottstein would have a more serious problem. Also on December 15, Gottstein outlined his new strategy for the big bank: For Gottstein, the transitional phase at the bank will be over by 2020. Instead, the «growth phase» with more profit and volume will now begin for him. Especially in the core business with wealth management, the bank boss wants to see the pace increased.

Such a leap forward is probably much more difficult to achieve with disgruntled super-rich people.