The Swiss wealth manager said it is approved to go on the deal hunt again, after a more than one-year time-out due to a Venezuelan money-laundering scandal.

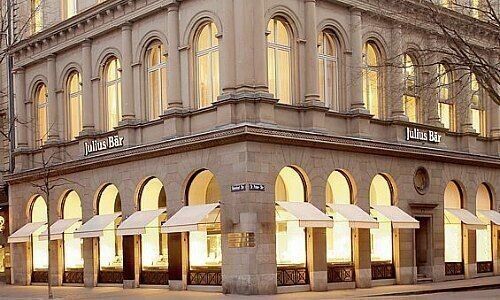

Zurich-based Julius Baer has its regulator's blessing again to be making major acquisitions if it wishes to, it said in a statement on Wednesday. Finma had barred the Swiss bank from making large, transformative deals as part of a sanction over PDVSA last February.

The move represents part of a long list of remedial measures that Julius Baer worked through in ridding itself of aiding Venezuelan graft. Those include adapting its growth targets to focus less on new money in the door as well as retooling how it pays its private bankers.

Supervisor's Scrutiny

Finma will continue to «closely accompany Julius Baer until the full implementation of these measures through the mandated auditor and additional supervisory measures,» the bank said. In January, Finma began enforcement proceedings against two ex-Julius Baer bankers over PDVSA.

Ex-CEO Boris Collardi, now a partner at Geneva's Pictet, escaped further scrutiny. Under Collardi, Julius Baer swallowed its largest deal to date: Merrill Lynch’s private bank outside the U.S. in 2012.

Organic Vs Big Bang

Current CEO Philipp Rickenbacher has emphasized organically growing, by acquiring teams. The Swiss banker had already sniffed around one boutique firm, finews.com reported in January.

Rickenbacher, in the top job for 19 months now, has ambitions to grow – including by acquisition – in Germany, the U.K. where Julius Baer has been hiring copiously since 2017, in the Iberian Peninsula, or even onshore in Asia, where he is eyeing the Chinese market, the CEO has told associates.