The Swiss bank will reportedly dismiss risk boss Lara Warner in the coming days and it pieces through the financial damage of its business with Archegos.

Zurich-based Credit Suisse is poised to dismiss risk and compliance chief Lara Warner (pictured below; image from Harvard Kennedy School) as soon as this week, «Bloomberg» reported on Sunday, citing sources. It is also considering the fate of top investment banker Brian Chin, the agency reported. A spokesman for Credit Suisse didn’t comment.

The Swiss bank may give investors an idea of how vast the financial wreckage from the hedge fund unwinding as soon as Tuesday, «Sonntagszeitung» (behind paywall, in German) reported earlier on Sunday, citing a source saying estimates range as high as $5 billion. Credit Suisse is in the midst of a perfect storm of major crises – Archegos and Greensill – as well as a leadership vacuum.

Chairman Emblematic

Urs Rohner (pictured below) is emblematic for the Swiss bank’s misfortunes because he has presided Credit Suisse for the past decade. Calls are mounting for him to leave before his term ends and hand the crisis to successor António Horta-Osório immediately, instead of waiting until the handover on April 30.

Raft Of Repairs

The Swiss weekly, which had first reported that Warner is on her way out and that Chin's job is hanging by a thread, also reported that Credit Suisse is preparing to disclose a series of repairs alongside the financial wreckage. The damage is expected to wipe out its profits this year and may necessitate a cap hike.

Those measures include a management clear-out as well as top executives and board directors relinquishing pay, the outlet reported. CEO Thomas Gottstein is not among those whose job is on the block, according to both «Bloomberg» and Swiss media.

The bank – Switzerland's second-largest after UBS – is weighing halting its share buyback and whether to already cancel its plan for a higher 2021 dividend, or curb or postpone the shareholder payout, «Sonntagszeitung» reported, citing a person familiar with Credit Suisse’s board’s discussions.

Pre-Emptive Handover?

The volume of the scandal is higher in Switzerland, where the bank's history is intricately entwined with the country's infrastructure development in the 19th century. Sixty-one-year-old Rohner, who has successfully weathered criticism from both domestic and international outlets and commentators since 2014, now faces leaving before his decade-long term is up.

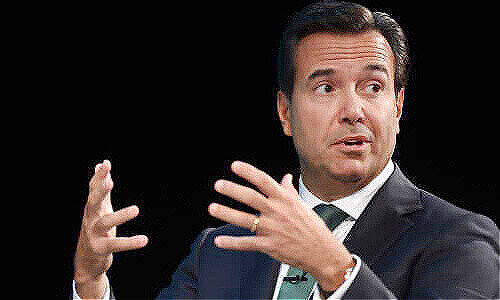

On Saturday, influential «Neue Zuercher Zeitung» (behind paywall, in German) called for Rohner to consider handing over to Horta-Osório (pictured below) immediately, instead of in three weeks – the business-friendly outlet was echoing a call last week by another Swiss outlet, «Finanz and Wirtschaft» (behind paywall, in German).

By contrast, «Sonntagszeitung» reported on Sunday that this is unlikely, without elaborating on sourcing or reasoning. The idea of an early exit by Rohner as a concession and to mark a new beginning had been making the rounds last week: the Swiss lawyer is «deeply shaken» by the recent events and fears a similar fate to disgraced ex-UBS Chairman Marcel Ospel, «Sonntagszeitung» reported.

Skipping Vote On Backing?

Credit Suisse’s board, which is vice-chaired by Roche boss Severin Schwan, is weighing whether to skip a motion to back management and board of responsibility for last year, the weekly reported. The «dismissal» or décharge is a formality of Swiss securities law that prevents shareholders from later taking legal action against executives and directors.

The item is already slated on the invitation to Credit Suisse’s shareholder meeting. In 2019, UBS’ shareholders denied the bank’s top echelon the same backing, due to a potentially costly French criminal trial.