Heavyweight investors are tempted by bitcoin repeatedly hitting new all-time highs, but turned off by the cryptocurrency's volatile swings. A Robeco portfolio manager parses how much bitcoin belongs in a portfolio.

At $10,000 per bitcoin last year and more than six times that today: what if under-pressure Swiss pension funds and other major institutional investors had plowed some of their money into digital assets 12 months ago?

These types of investors have been slow to warm to digital assets, scared off by the thousands of choices as much as the volatility of lead cryptocurrencies like bitcoin, ethereum, or Ripple's XRP. Pension funds and insurers are also typically hidebound by tighter regulation than other major institutional investors.

«Extreme» Asset Class

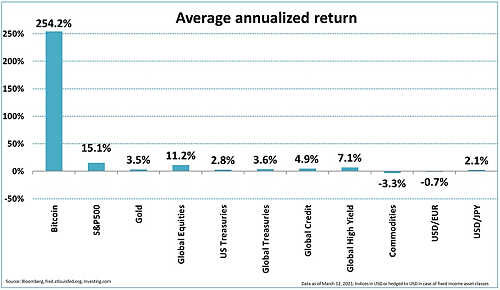

And yet the returns – and eye-watering 254 percent per year since it first started trading on exchanges in 2010 – are enticing. Robeco portfolio Jeroen Blokland calculated that a standard and well-diversified multi-asset portfolio can withstand up to 2.5 percent invested in bitcoin.

«Given its potential of becoming a store of value as digital gold, we consider bitcoin to be an asset class, albeit an extreme on,» Blokland wrote in «Bitcoin As Digital Gold». «Virtually all of its characteristics are very different from traditional asset classes.»

The portfolio manager's biggest concern remains the volatility of cryptocurrency, which is why he recommends capping portfolio exposure at just one percent. This aligns the digital asset better with overall portfolio management, including rebalancing, Blokland said.

Digital Gold's Inherent Value

He sees bitcoin's market capitalization rising to $3 trillion by 2031, compared to $1 trillion currently. This assumes that the digital assets reaches the same market cap as investable gold – or that used for investment or in some way linked to financial markets. That in turn implies returns for bitcoin of up to 25 percent per year.

Blokland noted that criticism over bitcoin's lack of intrinsic value is largely irrelevant. «As with diamonds, art, stamps, gold and the US dollar, bitcoin does not provide cash flows. Yet, all these asset classes have monetary value, and most of them are considered to be a store of value,» he wrote.