The reputational damage to Credit Suisse from the Greensill and Archegos debacles has been greater than previously thought and is hitting its top specialism, the bank’s results show.

It comes as no surprise that Credit Suisse has had a bad first half.

The collapses of the Greensill Capital's supply chain funds and U.S. hedge fund Archegos Capital Management are still weighing heavily on the business. The announced cutting back of capacity and risks at the investment bank also managed expectations surrounding the results published Thursday.

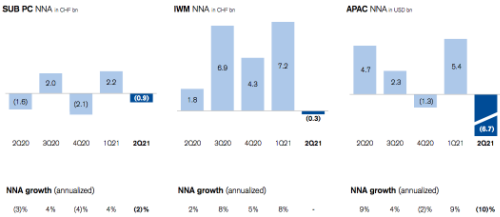

The surprise comes in the obvious weakness in its top specialism, wealth management, particularly in the growth region of the Asia-Pacific and in International Wealth Management.

Net outflows came to 4.7 billion Swiss francs ($5.1 billion). In other words the Archegos and Greensill crises have left their mark on wealth management, something the bank had long denied.

Fall in Net Inflows

To the bank's credit, it seems to have deliberately let certain customers in Asia go. But in light of the bullish financial markets, it would normally have achieved a better result just like other Swiss financial institutions have done in the first half.

However, its recent past is obviously eating away at Credit Suisse as the falls in net new money in the three asset management divisions (SUB, IWM, APAC) show (see chart below).

(Click to expand)

That is bad news for a bank where so much is still a work in progress. New customers will think very carefully about whether they want Credit Suisse to manage their money especially when its competitors can now play to their strengths from a better position.

New figurehead?

The continuing flow of bad news about Archegos and Greensill combined with the uncertainty surrounding the bank’s future strategy, which Chairman António Horta-Osório will have worked out by the end of the year, is hardly likely to be conducive to developing the business over the next few months.

It is quite possible that the new strategy, which is set to be announced by the end of the year, might mean even more top managers being replaced – up to and including CEO Thomas Gottstein, who is still firmly in place. However, a CEO unsullied by the past might make a better figurehead for the bank next year.

Bonus Clawback

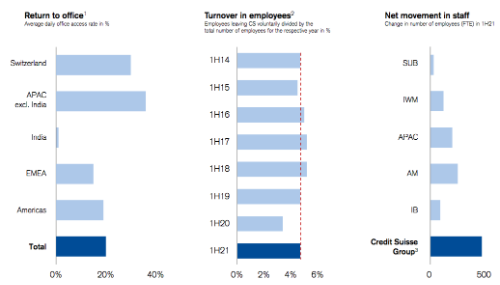

For the time being, however, the main thing will be to stem the flood of employees heading for the exit the bank has experienced in recent weeks. Churn was particularly high in Asia and asset management, as the chart below shows.

(Click to expand)

The number of departures from investment banking, which have been given a great deal of media attention, are (still) limited. But the announcement on Thursday that 23 people were sanctioned over Archegos and around $70 million in remuneration were adjusted, cancelled or reclaimed, is not very likely to boost the morale of Credit Suisse’s investment bankers let alone tempt people to join them.

Rocky Road

With a wealth management division that has taken a knock, the strategic uncertainty in asset management and an investment banking division that will be more risk averse, but also less profitable, Credit Suisse with Horta-Osório at the helm is likely to have a rocky road ahead of it until the things return to normal.