The latest rankings show three companies dominate the Swiss fund management business but that the challengers are hot on their heels.

Bullish financial markets in the first half of 2021 have meant a 10 percent rise since the start of the year in the amount put into Swiss investment funds taking the total invested to 1.47 trillion francs ($1.62 trillion), according to the latest statistics from Morningstar and Swiss Fund Data.

Many investors were incentivized by soaring equity markets, with around 30 billion francs in new money flowing into funds. The most popular investments were bond funds (18.9 billion francs), followed by equity funds (7.6 billion francs) and investment strategy funds (6.2 billion francs). There were only net withdrawals from two fund categories – most of them from money market funds (5.0 billion francs).

Strong Competition

«There were in some cases strong inflows in bond, equity and investment strategy funds, while capital flowed out of money market funds, which are mostly used to «park» capital in uncertain times», Managing Director of the Asset Management Association Switzerland Adrian Schatzmann said. Most of the money (691 billion francs) is invested in equity funds, followed by 433 billion francs in bond funds.

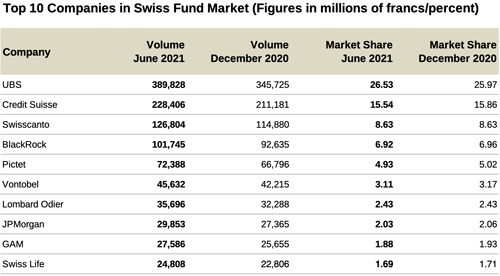

Three Swiss providers dominate the business, while a foreign asset manager is hot on their heels. UBS is the undisputed number one in Germany with a volume of around 389.8 billion francs, which corresponds to an increase of 44.1 billion francs since the beginning of the year (see table below).

(Click to enlarge)

UBS managed to extend its lead and now has a market share of 26.5 percent compared with 26.0 percent at the beginning of the year.

Credit Suisse has grown less strongly due to the Archegos and Greensill scandals. Its funds increased by 17.2 billion to 228.4 billion francs. But this was not enough to grow its market share which shrank to 15.5 percent from 15.9 percent at the beginning of the year.

Shifts in Market Share

Asset manager Swisscanto, which now belongs to the Zurich Cantonal Bank (ZKB), kept its market share stable at 8.63 percent.

Despite significant volume inflows, the next two fund providers lost ground: Blackrock had a market share of 6.92 percent, down slightly from 6.96 percent at the beginning of the year, and Pictet's asset management division had a market share of 4.93 percent, down from 5.02 percent.

The statistics are based on the Finma approval list and include all funds under Swiss law as well as all foreign funds authorized for public distribution in Switzerland, including their institutional share classes.

Foreign funds, which are reserved exclusively for qualified investors, are not included in the statistics because these products are only placed privately and cannot obtain authorization from Swiss financial regulator Finma.