Signs of growing imbalance in Switzerland's red-hot property market are emerging, according to analysts at UBS.

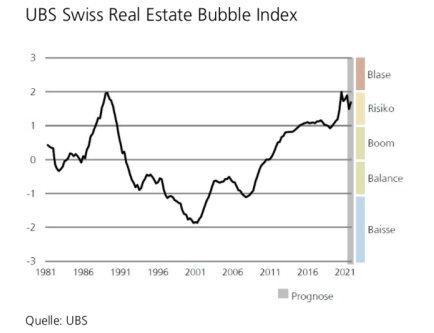

The Swiss real estate bubble index rose in the second quarter to 1.90 from 1.78 points, UBS said on Tuesday – it had already risen in the first quarter and remains in the so-called risk zone, according to the Swiss bank's analysts.

Sharply higher prices and mortgage volumes against the backdrop of lower rents and stagnating household income indicates a growing market imbalance. Housing prices have risen 5.4 percent on the year – the biggest jump in eight years. This has widened the gap to household income considerably.

Widening Rent Vs Buy Gap

While an average of 6.5 annual incomes were required to buy a Swiss home last year during the pandemic, the metric now stands at 7.1, the bank said – in short, fewer residents can afford to buy homes.

A stepping up of the pace of mortgage lending rising would be a warning signal, UBS noted. Growth in outstanding home equity loans has accelerated in recent months, with volumes nearly three percent higher on the year.

This contrasts with a 3.2 percent fall in rental prices on the year – the sharpest drop since 1996 – feeding a widening gap between purchase and rent prices. This means that rental income on buy-to-let investments as well.

Cities Overheating

Regionally, Zurich, Zug, Basel, Lausanne, and Geneva are at risk of overheating, with house prices unlatching from household income and rental rates the strongest. A liquidity risk – more supply than demand – is predominantly happening in Ticino, parts of Valais, and in Jura.

UBS' experts see an easing of the property market by year-end, not necessarily because of prices edging lower but because the bank expects an economic recovery in the back end of 2021. This should prevent the index from rising into bubble risk territory: UBS forecasts a year-end reading of 1.69, lower than the second quarter's level.