Switzerland is still a leading financial hub. But measured by growth in assets under management, it only placed sixth last year - barely in front of Hong Kong. What happened?

No country attracts more international private clients than Switzerland does. But when measured by growth, it only placed a mediocre sixth in 2020, just in front of Hong Kong, at least according to a Deloitte survey.

Although political stability became increasingly important during the pandemic, the collapse of talks over a framework agreement with the European Union clearly weakened Swiss finance. And talks about further market access have since become far more difficult, the authors of the study maintain.

New Models Needed

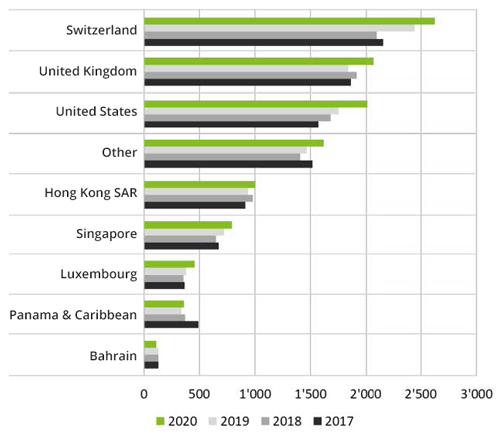

Swiss banks are going to have to create radical new models to digitally interact with clients and expand their palette of available products despite the $2.8 trillion in assets under management booked here, which makes the country first placed worldwide, ahead of the UK and the US.

(Data: Deloitte, design: finews.com, click to enlarge)

Although top positions remained relatively stable last year, the US, UK and Luxembourg managed to make up ground because of the dynamic growth rates they posted on the back of a strong recovery following the first COVID-19 shock. Switzerland only managed to post growth of 7.3 percent, which is significantly below the weighted average growth seen for all financial centers.

By comparison, Luxembourg grew 20.7 percent last year, the US 14.8 percent and the UK 12.7 percent. When it comes to volume, the 7.3 percent rate places among the last, at least according to this fourth edition of the Deloitte International Wealth Management Centre Ranking.

Little New Money

The most important thing the survey showed was that investors were diversifying their assets into «safe havens», ones that are notable for their political and financial stability - and service offering. Despite that, Switzerland did not manage to attract significant levels of new assets, the survey indicates. The absolute increase in volume is mainly due to the appreciation of the Swiss franc against the US dollar during the pandemic.

The report indicates clear priorities that have to be set if Switzerland does not want to fall behind its competitors. Clients should be given easier access to private equity, crypto-currencies and digitalized token assets. Companies also need to invest in data and analysis tools that allow for a more efficient and differentiated increase in productivity. They also have to sharpen their focus and find ways beyond pure financial incentives in order to attract young employees.

When measured by competitiveness, Switzerland remains on top, followed by Singapore and Hong Kong. This is remarkable in and of itself in that growth in Asia is expected to continue to surpass that of other regions, with its only competitive weaknesses being its small domestic market and the relatively low profitability rates of its wealth management providers.