Amid a hiring frenzy for ESG talent, banks’ fiercest critics could be key to advancing their sustainability efforts.

Banks and insurers are ramping up recruitment to meet the ever-growing sustainability demands from investors and regulators. Fueled by a global health crisis and social justice movements, salaries for ESG experts for financial institutions are soaring.

The importance of environmental, social, and governance (ESG) knowledge in business is so strong that «some CEOs won’t go into an investor meeting without taking their chief sustainability expert with them,» Natalia Olynec, sustainable head at IMD Business School says.

However, this wasn’t always the case.

From Threat to Strategy to CEO

Sustainability expertise in banks were first placed in legal and compliance departments, suggesting that anything ESG-related was something banks needed to protect themselves against. From there, ESG expertise was integrated into the bank’s financial reporting area.

«Now sustainability is seen as a business case,» Daniela Haze Stoeckli a partner at Mind Your Step, a career advising firm, which works with top executives and board members, says. Businesses have recognized that it is something they can use to position themselves in relation to clients and talent acquisition.

«The topic has been catapulted to board level, becoming integral to companies’ strategy,» she adds.

If developments in other industries - such as H&M’s CEO Helena Hamerson’s ascent – are anything to go by, «the chief sustainability role could become a stepping stone to the CEO role,» according to Olynec.

For those not quite at that level yet, a good salary and premium might come with the job, as strong demand hikes up remuneration in the specialist area.

Forming Alliances

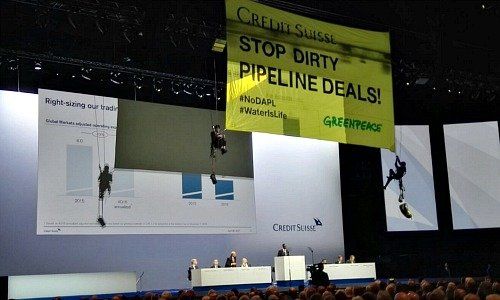

A look at leading sustainability profiles at Swiss banks show that they are wary of hiring financial professionals who have veered too far away from banking. They prefer to lift employees with linear careers into these key positions. Credit Suisse’s Marissa Drew who stepped straight into the the Swiss bank's sustainability chief role from investment banking, is a good example.

It might however take some more versatile candidates who don’t fit the typical Wall Street mold to drive the transition as sustainability moves from the fringes of organizations to their center. It could involve bringing in critics, who until now, have sat at the other side of the table.

«It is essential that banks learn that they need a more varied skill set for this radical transformation» WWF Switzerland’s chief executive Thomas Vellacott, who started his career as a private banker, says.

«At non-governmental organizations you learn that you cannot tackle issues alone and that you need to form alliances,» he adds.

Moral Imperative vs Business Case

Mainstream banks could learn from independent banks such as the Alternative Bank Switzerland, which have long made it their mission to use finance to deliver sustainable economic, social and environmental development.

«The main difference between mainstream banks and non-governmental organizations is that NGOs are purpose-driven,» whereas banks are business-driven, Martin Rohner, executive director at Global Alliance for Banking on Values, says.

«Sustainability needs to be a moral imperative to really bring about change,» Rohner says. «As long as banks adopt sustainability for its strategic rationale, to simply please clients with an affinity for these topics, it won’t make any difference. Not in the real economy,» he says.