The Swiss bank's new overseer said he hopes to steer Credit Suisse into calmer waters and homed in on what he views as its biggest challenge.

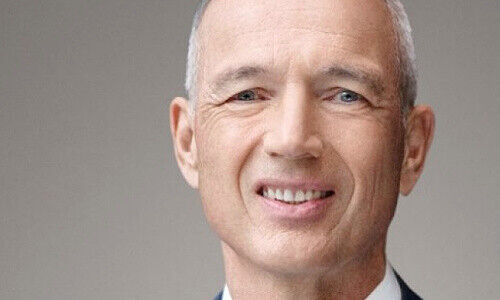

Axel Lehmann, Credit Suisse's chairman from Monday, hopes the scandal-tarnished Swiss bank can focus on its business activities and get on with a restructuring launched by his predecessor, he said in an interview with «SRF» (in German) on Monday. Lehmann was parachuted in for António Horta-Osório, who resigned over his personal conduct.

«I hope that it is perceptible that I can steer Credit Suisse into calmer waters. That we can focus on client business, the implementation and the transformation of Credit Suisse as a worldwide group,» the 63-year-old Swiss finance veteran said.

Cultural Of Risk-Taking

He took over after Horta-Osório was given the choice of resigning or being ousted, as finews.com reported earlier on Monday. Last year's double-whammy of Greensill then shortly after Archegos' $5 billion in losses, lay bare that Credit Suisse is not just operationally but also morally adrift, finews.com commented.

A risk veteran of both UBS and of Zurich Insurance who chairs this committee at Credit Suisse, Lehmann said the bank's managing of risk-taking remains a huge priority. «It is important that we keep an eye on our risk systems, our approach, how we improve our risk management,» he told the Swiss broadcaster.

Taming Investment Bank

However, he noted like Horta-Osório before him that cultural transformation is «far more important» to Credit Suisse: «We want a solid, good risk culture in our firm where we conscientiously take risks. Banking is about risk-taking, but not too major or incalculable.

Lehmann, who was elected to Credit Suisse's board less than four months ago, said he fully backs the strategy laid out by Horta-Osório in November. «The strategy isn't changing. We want to focus on the Swiss business, on wealth management, and on the risks in our company, specifically in the investment bank,» he said.