Climate activists and major investors prepare for the Swiss AGM season. But time is running out for the banks.

Ralph Hamers said it almost as some kind of precautionary step: «We have to identify and master the important milestones on the path towards our long-term objectives». The UBS CEO was commenting on the bank's climate report published last Friday.

For him, it seems clear that his institute needs time before it can reach its medium-term 2030 targets. And that is not even getting into the «Net Zero» 2050 target the bank has set to rid itself of all greenhouse gas emissions.

Paying Lip Service

But time is exactly what Switzerland's largest banks do not have. Over the past weeks, NGOs, shareholder representatives, and institutional investors have massively increased pressure on the country's key institutions, as finews.com reported.

Earlier this month, a group of 11 investors sought to use shareholder resolutions to bring greater transparency to Credit Suisse that reduce the bank's exposure to financing fossil fuel companies, according to the Ethos Foundation then. They believe banks are simply paying lip service to «Net Zero».

Diverting Financial Flows

The accusations shouldn't be taken lightly. Institutions that do not fully jump on the sustainability bandwagon risk being left behind in the global financial markets. The Science Based Targets Initiative (SBTI), which counts over 1,000 companies, including Swiss finance, has established clear guidelines on how to deal with climate offenders.

The EU has created a new taxonomy for sustainable economic activity. This, at a time when Sustainable Finance Disclosure Regulation (SFDR) is actively directing investor funds into ESG. It all goes to show that the mainstream money flows of finance are being diverted to new, and greener, pastures.

Shifting Activity Away From Fossil Fuels

Because of that, the two main Swiss banks tried to show how much they were shifting activity away from fossil fuels when releasing their sustainability report cards last week. Credit Suisse declared that it had cut its lending to the oil, coal and gas sector by 41 percent between 2020 and 2021.

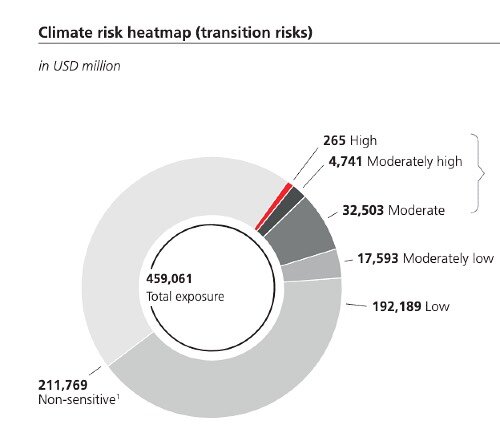

But they still have about $2.6 billion of those types of credit on their books. At UBS, lending to fossil fuels industries totaled $265 million. But when you include sectors that have a moderate to moderately high impact on the climate, then the exposure increases dramatically to $37.5 billion (see graphic below).

Only Fair

According to UBS, the volume of lending to climate-sensitive sectors has fallen to $373.2 billion from $437.8 billion. The institute also announced that it is cutting the CO2 footprint of its credit book, particularly in the fossil fuel, power and real estate sectors. Taken together, they currently comprise 43 percent of all lending.

The question is whether climate activists and key shareholders will think this is all enough. The «Say on Climate» campaign is likely to become a large issue during this year's AGM season. «It is only fair that NGOs are asking for the finance sector to implement the promises they made at the COP26 summit», says Susanne Döbeli, head of Swiss Sustainable Finance (SSF) and a key voice in the market. UBS and CS are SSF members. From her point of view, activists are playing the part of a control function and the «increased pressure is valid.»

Quick Promises

But Döbeli said that timelines have to be realistic. «It is easy to make a Net Zero promise. Implementing them takes time. Given the legacy portfolios that all banks start with, that can take years.» It is also not surprising that NGOs find lending or financing that they find problematic.

But the SSF also knows that time is ticking. In December, the association created a road map together with members. By 2030, it wants them to be in a position where they are fulfilling their sustainability targets. But that is a promise that still has to be kept - while both the government and authorities are starting to lose patience. Particularly when it comes to «greenwashing» or deceptive practices when it comes to sustainably declared financial products.

Government Regulation Threatens

In November, the Swiss government threatened to impose regulation. It requested that the finance ministry suggest changing financial market legislation by 2022 in a way that prevents greenwashing.

In finance, given the little time that is left, the only hope is that the government's regulation will be proportionate. «The government has relayed a clear expectation to the finance sector for their responsibilities when it comes to climate targets», Döbeli said.

That has set much in motion. «It can be assumed that the regulators understand the importance of this kind of momentum and give industry the time to implement the needed measures.»