Several items on the agenda at the annual general meeting could turn it into a baptism under fire for new chairman Axel Lehmann.

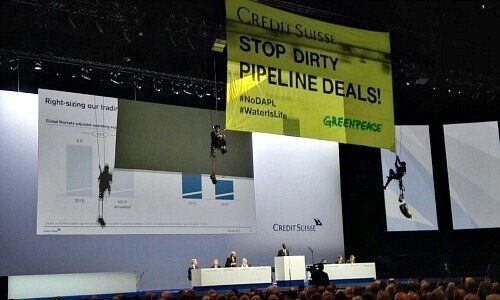

Credit Suisse's shareholder meetings have kept everyone on edge in recent years. Who can forget the abseiling Greenpeace activists unfurling a banner behind then chief executive Tidjane Thiam in 2017 (image above).

This year's meeting, which will be held on 29 April, looks just as fraught for Axel Lehmann (image below), who became chairman in January. Last year was a turbulent one ending in a loss and there are several items on the agenda released yesterday that could potentially face a great deal of criticism from shareholders.

The meeting will again take place virtually because of the pandemic.

(Axel Lehmann. Image: Credit Suisse)

1. Partial Liability Discharge

finews.com has reported about the possibility that shareholders won't fully vote to discharge the board of their legal liabilities as the resistance to the measure seems to be growing. This is due to the forced closure of the Greensill supply chain fund and an internal report on the matter, which the bank does not want to disclose publicly. At last year's AGM, because of the Greensill and Archegos losses, the bank didn't even put the usual discharge on the agenda.

Now the board is at least hoping for a partial one. The Greensill case is being excepted from the vote, as Credit Suisse indicated in its meeting invitation yesterday. It is instead recommending that shareholders reject the request by the Ethos Foundation for a special audit on that and the «Suisse Secrets» leaks in a separate agenda item.

2. Special Audit Tug-of-War

The Ethos proposal is likely to generate controversy. Together with a number of Swiss retirement funds, it is asking the bank to answer numerous questions related to both matters, the latter of which resulted in a data leak involving 18,000 accounts ostensibly held by criminals and corrupt heads of government.

Ethos appears to be asking detailed questions on the 10 percent of the accounts the bank has disclosed it still has relationships with.

3. Climate Change

Shareholders have also requested an agenda item on the bank's climate change strategy. The Ethos Foundation and Shareaction, an NGO, have submitted a motion in the name of 11 large investors. It demands an amendment to the bank's articles of association by further aligning oil, gas and coal sector reporting and disclosures, as finews.com previously indicated.

Credit Suisse doesn't agree with the step, saying that it already has various measures in place related to climate change and that it will institute additional ones in the future. The question is whether the bank will able to convince shareholders with its views as professional investors have in the meantime come under pressure related to the fulfillment of climate change targets.

4. Controversial Bonuses

Even banks that have had an extraordinarily good 2021 are facing heavy criticism by shareholders for the high levels of bonus payouts. And by that token, Credit Suisse was deeply in the red. Just that fact should make for a very heated discussion - despite the fact that the bank cut compensation for management and the board in 2021 compared with 2020.

For this year, the bank wants to set a maximum limit for executive management salary of 34 million Swiss francs. That is sure to raise eyebrows given former chairman António Horta-Osório's frenzied departure in January with a 3.5 million franc ($3.8 million U.S. dollars) payout.

5. Controversial Candidates

Horta-Osórios successor Lehmann did not have to worry about whether he would be elected as chairman but the same might not prove as true for the other board candidates.

Keyu Jin (image below) is standing for election and controversy has broken out over the Chinese economist. She is a professor at the London School of Economics and the daughter of a senior government official who is President of the Asian Infrastructure Investment Bank. She is known as an ardent, but nuanced, defender of Beijing policy, as a recent interview on «CBS News» shows.

But she also has made concerning statements on human rights issues, according to a report from «Tages-Anzeiger» (in German only), a Swiss daily newspaper.

(Image: Youtube)

Jin has called China’s widely condemned treatment of the Uighur Muslim minority in Xinjiang province, which includes «re-education camps,» a «legitimate» way of teaching Chinese language and culture, the report said. That’s a stark contrast to the United Nations' description of systemic human rights violations, including torture, forced sterilization and separating children from parents.

Fight Beckons

The bank is counting on her extensive network of connections in China, which is an important growth market for the bank. It is a perspective that could become sorely tested at the end of the month given the current geopolitical situation and Beijing's close stance with Russia.

Severin Schwan knows about changing perspectives. The vice-chairman, who was once known as a strong hand on the board, is not standing for election. Apparently, that is a voluntary decision. But it looks like some investors threatened to fight any attempt by the Roche CEO to stand for election again.