A group of Swiss economics professors is calling for reform at the Swiss National Bank at a delicate time for monetary policy.

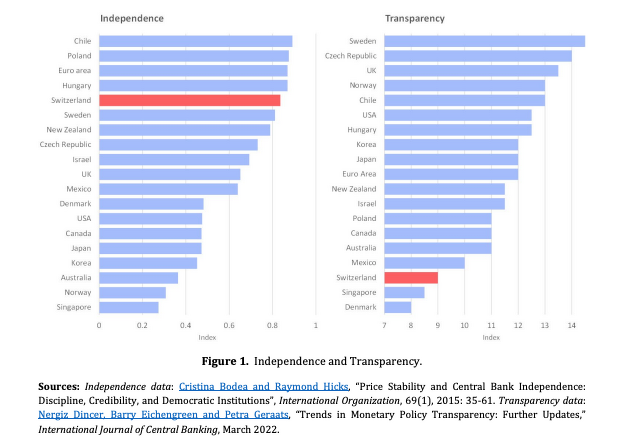

A report analyzing the proceeding and policies of the Swiss National Bank (SNB) found that it was a very independent institution, but one that lacks transparency.

«Among the developed countries, the SNB is one of the most independent but also one of the least transparent central banks. The SNB should improve transparency by providing more information about the background to its policy decisions,» wrote Stefan Gerlach, Yvan Lengwiler and Charles Wyplosz in a report published Thursday by the SNB Observatory.

Founded in February of last year, the organization's goal is to contribute to and stimulate a broader debate about the SNB.

Broadening the Debate

The economists suggest that the size of the governing board is too small, noting that small committees are «susceptible to groupthink,» they say.

Policy committees of an increasing number of other central banks have external members, who bring different perspectives to the debate. They are more likely to challenge accepted opinion and viewpoints which can promote a more robust debate among committee members.

Term Limits

Another aspect the economists looked at was the lengths of the terms by governing board members which have increased. They recommend limiting the number of reappointments. Members are being appointed at a younger age than previously and the general practice is to re-elect them until retirement.

Not Going it Alone

During its meeting on December 21, 2016, the Federal Council approved a report on monetary policy, after the discontinuation of the exchange rate floor for the euro. The report concluded that the Swiss National Bank had the appropriate governance and could perform its mandate effectively with the existing legal framework.

The authors noted that was a valuable report since the SNB did not commission independent external reviews of its operations and management of policy.

Being more open and adopting reforms is not something the SNB would be doing in isolation. The IMF, BIS, Bank of England, and Sweden's Riksbank are but some of the institutions that conduct such operational reviews.

Therefore, «it would be appropriate for the SNB to undergo such reviews regularly,» they conclude.