Several Swiss banks attracted record net new money inflows last year, but signs are emerging the money spigot may be closing.

Last year was a perfect storm for several Swiss banks' ability to expand assets under management (AuM) due to favorable market conditions and record new money inflows for some, finews.com found when analyzing last year's results.

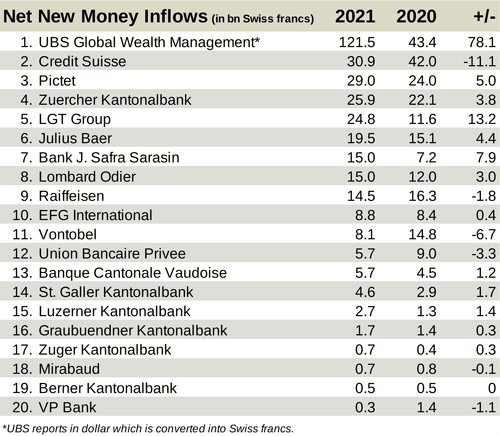

Pictet was one such institution, reporting «the highest ever net new money» across all business units of the company, and hauling in 29 billion Swiss francs ($31.7 billion) in 2021. That placed it third behind UBS and Credit Suisse in the finews.com rankings of net new money.

King of the Hill

J. Safra Sarasin was another, reeling in «record net new assets» of 15 billion francs last year.

The table below shows how 20 Swiss financial institutions fared last year in attracting net new client money. Once again, UBS was king of the hill and even though some firms attracted less money than the previous year, all still reported positive net inflows of new money.

Dark Clouds Forming?

This year, however, wealth and asset managers are facing geopolitical and economic uncertainty resulting from the ongoing war in Ukraine, inflation showing no sign of abating anytime soon. Add to the mix central banks that are starting to close the taps of easy money flowing into financial markets.

Vontobel addressed some of these issues at its annual general meeting (AGM) recently, foreshadowing some of the developments during the first part of the year. «In terms of inflows of net new money, the patterns observed in the second half of 2021 continued in the first few months of 2022,» Vontobel said in a report released in conjunction with its AGM. But whether that will continue is the proverbial million-dollar question.

Wealth vs Asset Management

One thing worth watching as banks report their first-quarter new money flows is where it goes. Vontobel said it continued to record strong net inflows of new money into its wealth management unit.

Similarly, LGT's «exceptionally strong» net new asset generation continued in 2021, with inflows of a record 24.8 billion Swiss francs. Its private banking generated net asset inflows of 13.8 billion francs, with capital partners chipping in 11.0 billion francs, according to the bank.

More Cautious Approach

But with the recent political and economic developments, this two-pronged strength might be vulnerable.

Asset managers appear to be taking a more cautious approach, and «institutional investors in Asset Management have remained on the sidelines in the current environment, which is characterized by rising interest rates and high levels of geopolitical uncertainty,» Vontobel said.

Canary in the Coal Mine

Another sign emerged Wednesday when Zurich-based asset manager GAM released its interim report for the first quarter, reporting its AuM declined during the period, shedding some 5.2 billion Swiss francs due to unfavorable market and foreign exchange conditions. That dropped the firm's AuM to 94.8 billion Swiss francs ($100.0 billion).

One thing that stood out in the report was that in the firm's investment management unit, clients pulled 270 million out of the firm in the first quarter. It remains to be seen if that development is a canary in the coal mine for new money inflows at other Swiss institutions.

More will be known about how all these developments are playing should become clearer next Tuesday when UBS reports its first-quarter results for 2022, followed by Credit Suisse on Wednesday.