The SNB hikes rates to tame inflation and ratchets up its inflation forecast while also adjusting the threshold for banks' negative interest exemption.

The Swiss National Bank unexpectedly hiked its policy benchmark today, pushing up the rate on sight deposits to -0.25 percent from -0.75, effective tomorrow. In the face of inflationary pressures does not rule out further increases, the SNB said in a statement accompanying the decision.

«It cannot be ruled out that further increases in the SNB policy rate will be necessary for the foreseeable future to stabilize inflation in the range consistent with price stability over the medium term,» the central bank said.

At a press conference announcing the decision, SNB President Thomas Jordan said the «tighter monetary policy is aimed at preventing inflation from spreading more broadly to goods and services in Switzerland. It cannot be ruled out that further increases in the SNB policy rate will be necessary for the foreseeable future to stabilize inflation in the range consistent with price stability over the medium term.»

Swiss Franc

In its monetary policy assessment for March, the SNB said «The Swiss franc remains highly valued,» but that was omitted from today's assessment which only stated that in order «to ensure appropriate monetary conditions, the SNB is also willing to be active in the foreign exchange market as necessary.»

Today's move by the SNB follows that of the U.S. Federal Reserve which yesterday also raised its benchmark rate by a more than expected amount in the face of stubborn and rising inflation.

Helping Banks

Negative interest rates have hurt banks who have to pay the SNB to hold funds and have affected their operating expenses. Another move undertaken by the SNB relates to this and is likely to be welcomed by banks. The change in that policy will adjust the threshold factor used to calculate the level of banks' sight deposits that are exempt from interest rates. This ensures that secured short-term Swiss franc money market rates are close to the SNB policy rate. This will take effect on July 1.

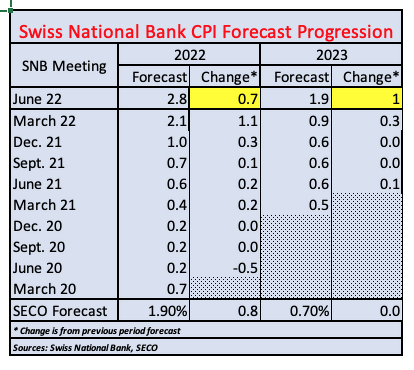

Inflation Forecast

At the same time, the SNB raised its inflation forecast to 2.8 percent for this year from the 2.1 percent it predicted in March. Perhaps more importantly, it also hiked its forecast to 1.9 percent for 2023 from its earlier prognostication of 0.9 percent, indicating that it expects inflation to persist.

The bank said that without today's rate increase, «the inflation forecast would be significantly higher,» the SNB said.

In its baseline scenario for inflation, the SNB assumes energy prices will remain high for the time being but doesn't expect an acute energy shortage in major economies. Citing elevated prices for food and energy combined with supply chain bottlenecks inflation is likely to remain high «for some time.»

«With monetary policy also becoming increasingly tighter in many countries, inflation is likely to gradually return to more moderate levels,» the SNB said.

Today's announcement underscores just how rapidly conditions have changed since the beginning of the year, and before Russia invaded Ukraine.

In February finews.com reported that while the tectonic plates of monetary policy were shifting, the SNB would be in no hurry to change policy because of lower inflation compared to Europe.

Those times have changed.