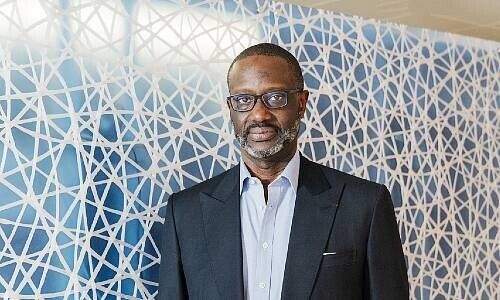

He strikes it lucky more than two years after being forced out of Credit Suisse. Although Switzerland still feels the impact of his legacy.

The ability to recover quickly from setbacks might be Tidjane Thiam's most impressive attribute as a manager, with the former CEO of Credit Suisse proving it once again just very recently. But it didn't look like that at the start of June.

Then, it seemed like he had finally managed to maneuver himself completely offsides with Freedom Acquisition, the SPAC he managed. Not only had the boom turned to bust but Freedom Acquisition and Pimco, a key investor, parted ways.

Large Scale Project

But as finews.com reported then, he already had another deal in the offing. Allegedly, he now wants to merge his SPAC with California-based genome mapping startup Human Longevity Inc. (HLI) for 345 million US dollars. According to media reports, that would value the company at roughly 1 billion dollars, which has caused the ears of many traders to prick up.

HLI is selling the promise of longevity. It runs comprehensive tests that include full-body MRIs and blood tests aimed at detecting aging-related diseases. The most expensive packages run to about 19,000 dollars.

Slowing the Aging Process

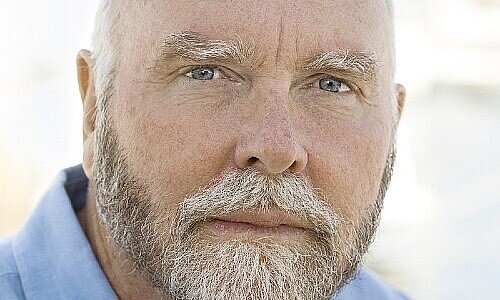

HLI's founders are Craig Venter (image below), a gene mapping pioneer, and Peter Diamandis, an aerospace engineer who became famous for the 10 million dollar X-Prize for privately financed spaceflight and the Singularity University. According to Forbes, the company he founded in 2013 doesn't just want to slow down the aging process, but they are trying to decode death with it. Indeed, it all looks like a veritable contemporary search for the holy grail.

(Image: Wikimedia Commons)

Even if they were knights on a roundtable, Thiam wouldn't miss a step. In 2011, as a French citizen born in the Ivory Coast, he was awarded the Legion of Honor, that country's highest decoration. As a film fan, he is probably very comfortable with the saga of King Arthur in any case, given that for years he was a board member of 21st Century Fox, part of media mogul Rupert Murdoch's empire.

It was also recently disclosed that Thiam was taking a stake in the planned Hollywood production «Gambino».

Failed Revolution

All of this makes one almost forget the mishaps during his tenure at Credit Suisse. He ran aground after only four years in office and just before the completion of his turnaround plan. In 2019, «Spygate» became public where Credit Suisse had been observing senior managers, among them Iqbal Khan, the former head of the international wealth management business, with detectives spying on his activities before he joined UBS.

Credit Suisse never really quietened down after that, even after several highly ranked dismissals. It came to a contest of wills between shareholders who were Thiam's supporters against the former chairman, Urs Rohner. And it almost seemed like Thiam was on the verge of a comeback. But they had not calculated on the wide-ranging powers of a Swiss board of directors.

In the end, in February 2020, it was Thiam who had to leave.

Together with Emma Watson

Even though it has been two years since Spygate, the affair is not completely over. Last October, Swiss financial market supervisor Finma slapped the bank with supervisory measures, reprimanding the institute and management for governance deficiencies. It also started new enforcement proceedings against three unnamed individuals and the investigations remain ongoing, with Finma refusing to disclose progress when asked.

Thiam recovered surprisingly quickly after being shown out the door in such a public and spectacular fashion, not least thanks to his excellent network. In April 2020 he was elected to the board of French luxury goods group Kering. He is still there, together with UK actor Emma Watson.

Among Legionnaires

The company, which includes the Yves Saint-Laurent and Gucci fashion labels, is chaired by François-Henri Pinault, son of the billionaire and Legion of Honor member François Pinault. The latter was also one of the first investors in the Freedom Acquisition SPAC.

Last May another prominent mandate seemingly fluttered in through the window. He was elected to the board of the French advertising and media group Publicis. It has been led by Maurice Lévy for many years, a man who is not only in the Legion of Honor, but a Commander in its ranks.

Suing Your Own Company

HLI's plans could allow the former banker to start making waves in the life sciences. But he will not be meeting Venter, as the flamboyant researcher and founder left the company four years ago. From the company's side, they indicated he had been fired, given it was going through operational difficulties then.

It was also when HLI sued Venters' research organization, the J. Craig Venter Institute (JCVI), accusing it of passing corporate secrets to other parties. But the charges were in all probability aimed at Venter himself, given he had left HLI in the direction of JCVI.

The suit was subsequently rejected in court. But the whole incident only served to bolster his image as a «bad boy» among molecular biologists.

Despite everything, Venter has made millions from his discoveries. He is a proud luxury yacht owner and his team was the first to create a synthetic cell in 2016. Those are also comeback attributes that he clearly shares with HLI interested party Thiam.