Credit Suisse lays out its ambitions for its wealth management division and streamlining its structure.

Switzerland's second-largest bank looks to overcome recent headwinds to its wealth management unit by further increasing revenue growth among its ultra-high net worth (UHNW) clients and accelerating it for high net-worth customers, Credit Suisse said in its Investor Deep Dive presentation Tuesday.

By being the «bank for entrepreneurs,» Credit Suisse says it is strongly positioned to serve the UHNW sector where it has loyalty across multiple generations of families. In addition, it said it will further enhance differentiating UHNW in areas such as private markets, lending, sustainability, and next Gen programs.

Among the HNW segment, the bank's goal is to increase recurring revenues and build on a favorable cost-income ratio. It will also «significantly expand» the HNW model in existing markets while extending it to Hong Kong and Singapore, according to the report.

Big 2024 Ambitions

By 2024 Credit Suisse seeks to have fully embedded sustainable investing into its advisory process, while doubling assets under management in private markets. Growth in credit volume is seen to be in the mid-to-high single digits.

The wealth management unit also will support the Credit Suisse group in expanding its sustainable finance efforts.

Market Plans

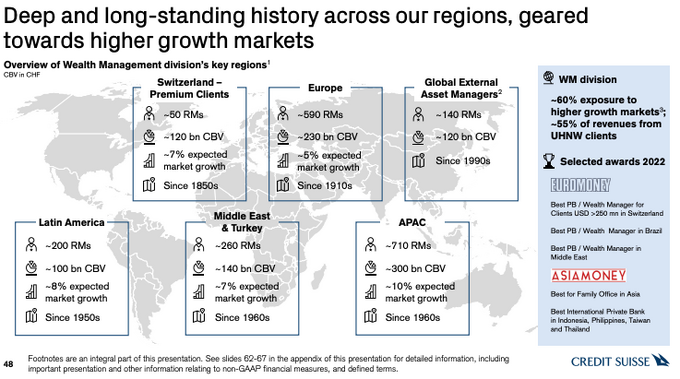

The bank is also planning to increase its scale in its top 20 markets with targeted initiatives and hiring new relationship managers and teams. It will also invest in technology-enabled client experiences.

At the same time, the bank seeks to reduce activities with an unattractive risk/return profile, while completing its exit from markets in Sub-Saharan Africa. It intends to remain in South Africa.

Higher Rates

Central banks are now tightening monetary policy, including the Swiss National Bank, and that will help banks as well, including Credit Suisse. It expects at least an 800 million Swiss francs net income increase in 2024 compared to 2021 from higher rates.

These are the drivers that Credit Suisse expects will drive the return on its regulatory capital to 18 percent by 2024. In 2019, that figure was 16 percent, dropping to 14 percent last year and 9 percent in the first quarter of the year.

The results were due to several factors, including low-interest rates, macro events such as deleveraging in the Asia-pacific region, and reduced client activities. In addition, the unit undertook «proactive de-leveraging measures.»