What is an investor to do when one piece of bad news follows another in the stock market? These days it appears to be taking the contrarian view and buying.

Bank research is often accused of being essentially there as a shill to encourage their customers to trade, and the fact that financial experts still find stocks to recommend for purchase in the middle of a crash might be seen as proof of this. But there are times when stock market players don't even need a push to leave the sidelines. This seems to be one of them.

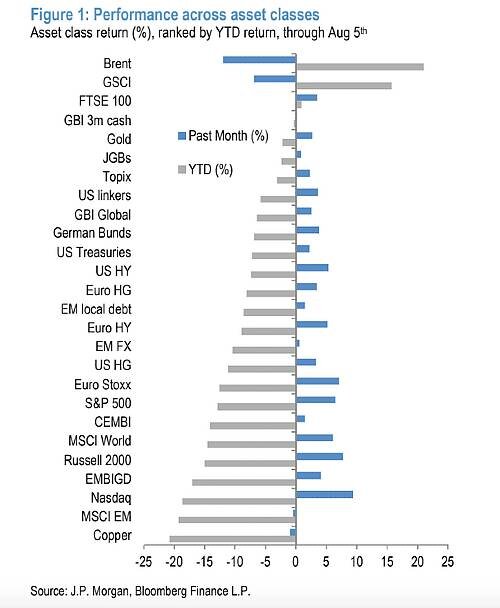

This is evident in the US at the moment where global financial market trends are being forged. Technically at least, the US economy is in recession after two-quarters of negative economic growth as measured by GDP. Yet, last July, both US Treasury bonds and blue-chip stocks in the S&P 500 Index delivered positive performance, as a chart from JP Morgan shows (chart below).

(Graphic: JP Morgan)

Market Peak?

One can certainly interpret this as a correction from the bear market of the first half of the year. Still, it is clear that, given the poor economic situation, investors now assume the US Fed will have to be cautious with further interest rate hikes in order not to choke off the economy. That would be to the advantage of stock investors as higher benchmark rates are usually poison for equity and bond prices. Because central banks, the Fed included, have abandoned easy money policies, US stocks markets experienced their worst first-half performance of a calendar year in over 50 years.

But the market phase where bad news is seen as good is a notion that is gaining traction, according to JP Morgan analysts. Now, the bet is that inflation and the Fed's willingness to raise interest rates have already peaked, they say. At the same time, they note the short-term outlook for stock markets remains challenging.

What Negative Surprises?

That the markets are already anticipating a turnaround in monetary policy appears to be causing unease among US central bankers. Several have publicly stated recently that the fight against inflation is far from over. As long as there is no change in the inflationary trend, the Fed intends to continue raising key interest rates rapidly and significantly.

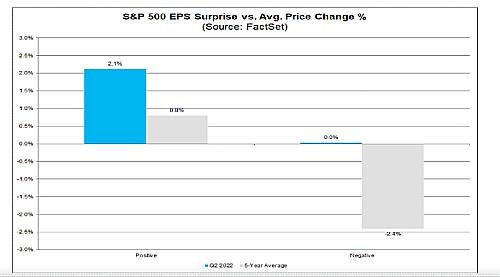

It remains to be seen whether these admonitions will be received by the equity markets or fall on deaf ears. If one gauges investor reaction to earnings reports of American companies last quarter as a yardstick, it is evident that worse-than-expected results currently have little to no impact on share prices, as a Factset analysis determined. Compare that to the past five years, when negative surprises immediately before and after earnings announcements were punished with price declines averaging 2.4 percent (chart below).

(Graphic: Factset)

Good For Swiss Bankers

Moreover, companies that exceeded expectations in their second-quarter earnings were rewarded with above-average gains on their shares.

In short, investors are interpreting the data differently than before, and are on the hunt for buying are more favorable prices. Swiss wealth managers including UBS, Credit Suisse, and Julius Baer, can only be pleased with this development. As seen shown during the market turmoil in recent months, their earnings power continues to be heavily dependent on the level of assets under their management, and valuation gains in the equity markets are likely to be highly welcomed by them.