Rising interest rates for the first time in over a decade are fundamentally good for banking. But when it comes to dealing with savers, banks now have to come up with lots of new ideas, observers say.

The end of negative interest rates in Switzerland is in sight after the unexpectedly large interest rate hike by the Swiss National Bank (SNB) in June, with further increases expected. The speed with which some institutions have responded by abolishing fees on balances alone gives a foreshadowing of what could happen if interest rates turn positive in Switzerland.

Banks such as WIR Bank, Valiant, and Glarner Kantonalbank (GLKB) immediately announced the end of fees on high credit balances. Many other institutions lowered their fees with a promise to lift them following the next hike in the benchmark rate.

Interest Rate Sensitivity

While banks do not anticipate fierce interest rate competition, customers are sensitive to prices and interest rates, and the willingness to move their money elsewhere is high. «Banks need to keep an eye on their liquidity ratio,» banking expert Philipp Kaupke (pictured below) tells finews.com, a partner at the strategy and marketing consultancy Simon-Kucher & Partners in Zurich, where he is responsible for the insurance and banking industries.

In the current situation characterized by uncertainty, clients have a more pronounced awareness of security and an increased need for advice, he said. «For years, stocks were recommended as an investment.» The simultaneous slump in stocks and bonds was unusual, he said, and with rising interest rates, cash is becoming interesting again.

While customers don't turn on a dime when it comes to banking, the banks should not risk large outflows on deposits. He points out that negative interest rates were also a source of revenue for banks, but now they need to adjust their funding.

«The interest rate turnaround requires a differentiated and larger deposit offering portfolio to give customers a choice of options.» Old-school products such as fixed-term deposits or bonus savings programs can't simply be transferred on a one-to-one basis to the new digital landscape, he said. «There is a danger lurking that if you are asleep when it comes to products, you will fall behind in your deposit strategy,» Kaupke warns. Banks need to actively communicate their products, he said, adding this is particularly true vis-à-vis the younger digital-savvy generation, which is experiencing a period of positive interest rates for practically the first time.

Savings Rate Normalization

Kaupke does not expect structural shifts in customer deposits. «In the past two years, the savings rate has been unusually high, and it can be expected to return to normal.» Given the uncertainty, there is also some caution among customers, and major purchases are being avoided or postponed.

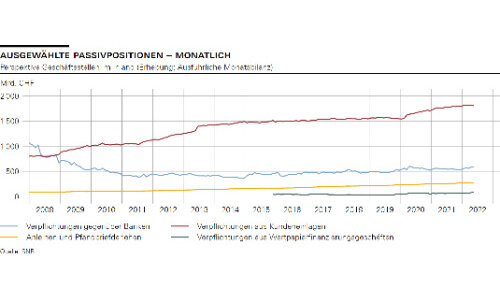

SNB data show the increase in customer deposits since the start of the Corona pandemic. From around 1.54 trillion Swiss francs, the value rose to more than 1.82 trillion Swiss francs in March 2022. Most recently, however, there had also been a slight decline here (red line on the chart below). But what happens next with savings deposits amounts to a big bet for retail banks.