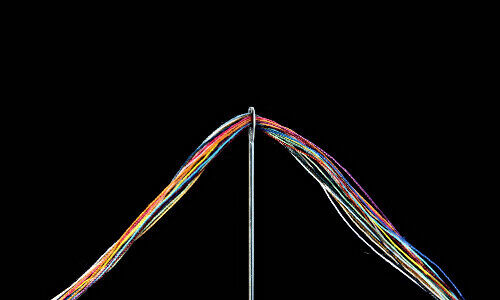

Independent asset managers in French-speaking Switzerland have to pass through Finma's eve of the needle.

Because of mandatory licensing requirements, independent asset managers in Romandie, the French-speaking region of Switzerland are being forced to reorganize and, above all, justify their costs.

The Swiss financial industry has been confronted with myriad problems in recent years. Debates over dormant assets, pressure from the US, France, and Germany, among others, to abandon banking secrecy, and the automatic exchange of financial information about clients are but a few examples.

What has resulted is a new financial market architecture with Fidleg and Finig as part of a new regulatory framework. The Fidleg contains rules for all financial service providers on the provision of financial services and the offering of financial instruments. Finig introduces a differentiated supervisory regime for financial institutions such as asset managers and trustees, managers of collective assets, fund management companies, and investment firms.

Increased Transparency

The laws that came into force at the beginning of 2020 are an expression of the determination that in a transparent world, where performance is key, only those who offer excellent service and are equipped with the best tools will succeed.

Independent asset managers who not only want to survive Fidleg and Finfrag coming into force and, more importantly, increase their profitability, are well advised to pool their costs with partners, says Geneva-based AWAP. The services company dedicated to independent wealth managers has 28 member companies and is in talks with other independent asset managers about joining, co-founder Anne-Sophie Tourrette told the financial portal «Allnews» (in French).

Increasing Regulatory Costs

The cornerstone of the service remains investment advice, even for these players. But this would have to be based on computerized traceability due to the new regulations.

To cope with the complexity of the new regulatory environment, AWAP even suggests outsourcing. This would allow independent asset managers to focus on their business and their clients while maintaining reliable cost control.

Time of the Essence

A study by PWC has also concluded that around two-thirds of the players see the costs in the compliance area and the increased reporting requirements as the greatest strategic challenge of the future.

The clock is ticking. Swiss Financial Market Supervisory Authority (Finma) has made it clear that independent asset managers who do not properly submit to the licensing process by the end of the year will be reported and placed on an index.

The industry is therefore waiting to see whether independent asset managers in French-speaking Switzerland will soon be converging under regulatory pressure.