As widely expected, December brought about the next round of central bank interest rate hikes. But to what level will interest rates rise and when can cuts be envisaged are the central questions for 2023.

The Federal Reserve (Fed), Swiss National Bank (SNB), Bank of England (BoE), and the European Central Bank (ECB) have rarely been so unanimous in raising interest rates in lockstep with their response to increase their benchmark rates by 50 basis points to get inflation under control.

It remains to be seen whether such a concerted approach will be repeated in the new year, particularly since the speed and amplitude of inflation and economic activity vary by economic region. This becomes clear from current interest rate levels alone.

Inflation Remains Decisive

While it is 1.0 percent in Switzerland and 2.5 percent in the eurozone, in the UK, where rate hikes started at the end of 2021, the current level is 3.5 percent. After seven hikes in succession, the range is now 4.25 to 4.50 percent in the US.

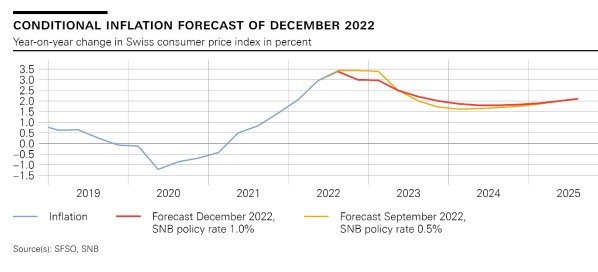

In its December estimate, the SNB adjusted its inflation forecast once again. It now assumes a more rapid short-term slowdown, but the curve then runs flatter and higher overall, with consumer inflation not expected to fall back to the 2 percent target level until 2024 (see chart below).

The SNB points to stronger inflationary pressure from abroad and broadening price increases across various goods categories in the consumer price index as underlying reasons. Inflation is now expected to average 2.9 percent annually in 2022, 2.4 percent in 2023, and 1.8 percent in 2024.

While inflation is seen going in the right direction, SNB President Thomas Jordan stressed in an interview with the Swiss TV channel «SRF» that Switzerland was not yet out of the woods in terms of inflation, and the forecasts are fraught with considerable risks and uncertainties. There are second-round effects that will keep inflation more stubbornly high, Jordan added.

The SNB currently expects GDP growth of 2.0 percent this year, slowing to 0.5 percent in 2023, underscoring the difficult balancing act facing the SNB of inflation and economic growth.

ECB: Hard Shell, Soft Core?

(Image: Keystone)

ECB President Christine Lagarde's (pictured above) words echoed strongest on the markets last week with her comments that eurozone interest rates will continue to rise «steadily and significantly.» Inflation is at a level that is «far too high,» and everything must be done to bring it back down to the 2 percent target band, she said. Most recently, inflation in the euro area was 10 percent, setting the stage for further monthly rate hikes until March, according to economists.

Together with the announced policy shift to «quantitative tightening» by tapering the sale of bonds, the stock markets took notice, and not in a good way. Still, some analysts expect the ECB will soften its position relatively quickly if signs of a recession emerge.

Imbalance Between Supply and Demand

(Image: Federal Reserve)

Earlier, Fed President Jerome Powell (pictured above) had emphasized his willingness for further hikes, repeating that interest rates will have to remain higher for longer to win the battle against inflation. In the labor market, there is still an imbalance between supply and demand, with rising wages leading to second-round effects and keeping core inflation high.

With their recent comments, Lagarde and Powell ensured that hopes evaporated central banks will back off somewhat from interest rate hikes in the face of a looming recession.

Rate Zenith in the Summer?

Economists now expect interest rates could peak in the summer of 2023, with initial cuts expected in the US first and coming toward the end of the year or early 2024 at the earliest. Interest rates there could reach 5 to 5.5 percent. In the euro area, the peak is seen at 3 to 3.5 percent, and the SNB could raise the key interest rate to 1.5 or 2.0 percent.