Cynics said they were surprised so many showed up. Others noted the modest tone at the crypto finance conference compared to previous gatherings, suggesting last year’s $2 trillion industry loss left no one unaffected.

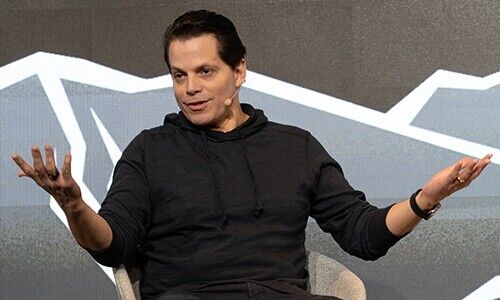

The industry is still in the «cleansing process» after the collapse of FTX, founder of hedge fund company Skybridge Capital, Anthony Scaramucci said in a panel discussion on the second day of the CfC St. Moritz. He also expects further fallouts to surface in the near term.

Scaramucci, who briefly served as former US president Donald Trump’s communications director, had a business relationship with Sam Bankman-Fried. He bought $10 million of FTT tokens, in return granting Bankman-Fried a 30 percent investment in his hedge fund. Scaramucci spent hours on the FTX trading floor, days even, but wasn't able to detect any malpractice at the exchange.

Scam Artists

He doesn't find this unusual. As with other sophisticated scammers like Bernie Madoff, Bankman-Fried possibly only let a few trusted lieutenants in on his alleged fraudulent activities, Scaramucci said.

It is important to remember «there are no new stories,» he added. Essentially one had to decide whether to be in or out. «I am in,» he said, referring to his commitment to crypto.

A financial industry veteran, he pointed to the similarities with the dot-com bubble over 20 years ago. «If you had sworn off tech then, you would have missed out on massive gains.» Scam artists were everywhere, he added

Mighty Effort

Still, it looks like it will take a mighty effort for the industry to move on from FTX. Just as initially reluctant institutional investors were developing an appetite for crypto, its credibility was shattered and its opponents vindicated.

«The only way to win institutions back is through trust,» Julius Baer Chairman Romeo Lacher said, representing traditional finance.

Second Best

Conversely, Union Square Ventures' managing partner and early investor in Etsy, Albert Wenger, needs no convincing of crypto’s attractiveness. «Now is the second-best time in its history to be invested in Bitcoin,» he said at the end of the conference's first day. He admitted he had failed to invest in the currency in 2009 which was the previous best time.

Other participants emphasized that Bitcoin losing two-thirds of its value over the prior year helped clear «less serious projects» out of the market, leaving quality founders offering attractive opportunities at realistic valuations.

Next Wave

Some speakers made the case for less talk about technology in favor of proposing tangible solutions for real-world needs. They said less mention of DeFi (Decentralized Finance) and Blockchain protocols and more concrete business cases would drive the next crypto wave.

For those who end up riding that wave, nothing speaks against keeping the modest tone.