Dividends and share buybacks provide shareholders with handsome returns. A new analysis shows that financial stocks can also shine in this area.

Earnings season is well underway and will dominate the Swiss stock market well into this March. Now, the focus is gradually shifting from last year’s numbers to companies’ annual general meetings (AGMs), when proposed dividends will be up for approval.

With Swiss government bonds yields at 1.4 percent, the current dividend situation looks very different from a year ago when they yielded around 0.2 percent.

Volatile and Risky

Even a mild recession, which is the consensus in the financial sector, could lead to less upside in the stock market making dividends important in the long term.

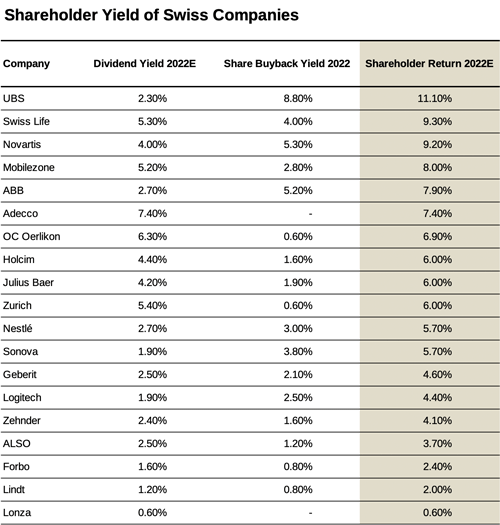

Although bank stocks are often considered highly volatile and risky, a survey by Vontobel shows how some stocks among financial companies, measured by their «shareholder yield,» are attractive. The shareholder yield is calculated by adding the dividend yield with the yield from share buybacks.

(Please click to increase table; Shareholder yield= Dividenden yield + Yield from share buyback; Graph: Vontobel, finews.com)

The study identifies 15 Swiss dividend aristocrats (see table above), all having managed to lift dividends over a minimum period of ten consecutive years. Interestingly, financial stocks are ranked at the top.

Switzerland More Attractive Than Europe and USA

According to the analysis, Swiss companies bought back shares worth a total of 34 billion Swiss francs ($36 billion) in 2022. This represents 3.7 percent of their market capitalization and makes Switzerland more attractive than Europe and the US in terms of share buybacks (Europe: 330 billion francs or 2.4 percent; US: 800 billion francs or 2.2 percent).

Out of the 20 companies with an ongoing share buyback program, Mobilezone, Novartis, Swiss Life and UBS offered a shareholder return of more than 8 percent for 2022.

Attractive Cash Returns

Based on its analysis, Vontobel identifies the following Swiss companies as offering attractive returns in terms of (tax-free) dividends and share buybacks:

All price targets are from Vontobel.

- Adecco ( Price target: 35 francs) with the highest dividend yield of 7.4 percent

- Holcim (Price target: 65 francs) with an after-tax dividend yield of almost 5 percent and an extensive share buyback program

- Mobilezone (Price target: 16 francs) with a shareholder return of over 8 percent

- Swiss Life (Price target: 625 francs), the Swiss dividend aristocrat with the highest 10-year dividend CAGR (21 percent)

- UBS (Price target: 22.5o francs) with the highest shareholder return of more than 11 percent due to extensive share buybacks.