Switzerland's largest bank is set to become far more dominant in the domestic retail market. The plans look good on paper but there are questions as to whether they will pan out that way in reality.

Colm Kelleher left little doubt on Sunday when the forced marriage between both institutions was announced in Berne. The Swiss business is an important pillar for Credit Suisse and it is something that Switzerland's largest bank will keep.

Later that evening, Kelleher was far more explicit when talking to investors and analysts.

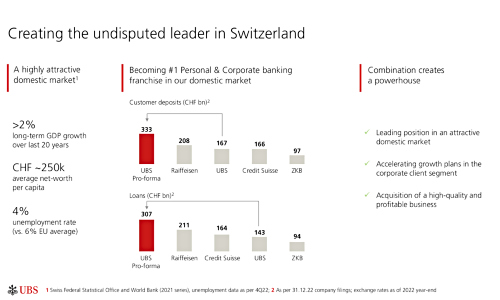

He indicated that the bank would expand its position as the leading universal Swiss bank by continuing to operate both brands as the «undisputed leader» in the domestic market.

Larger Than the Rest

The slides handed out (graphic below) show how CEO Ralph Hamers and CFO Sarah Youngwood will approach the gargantuan task.

The combined behemoth will have 333 billion francs (slightly more than $360 billion) in customer deposits and loans of 307 billion francs ($332 billion), which will make it the pre-eminent force in its home market.

According to all this, that would put the group of 220 Swiss Raiffeisen banks in second place. The merged entity will also decidedly outstrip all 24 Swiss cantonal banks, including the largest, the Zurcher Cantonalbank.

No Competition

UBS also received additional guarantees when it comes to glaring competition issues in what is a fairly small-sized market.

Just as it did with the government ordinance allowing it to bypass the requirement for a shareholder vote, the Swiss Financial Market Supervisory Authority (Finma) will invoke an emergency clause rendering competition law moot.

Given this, the competition commission is going to have to carefully watch how the market develops.

Regional Banks Say Little

When asked by analysts about that very issue, Hamers indicated that the bank will do its best to avoid a situation where it was breaking competition law because of the merger which is why it asked for the clause to be invoked.

Still, it is surprising how little resistance the supersized number one position of what will be the future market supremo is getting.

The regional banks, which were highly successful in lobbying to prevent government-owned Postfinance from getting into the loans business, are saying little, if anything, about the current deal.

Challenging Situation

The Association of Swiss Cantonal banks said it is hard to see what the market implications of the UBS/Credit Suisse merger are currently. «the market's dynamics are sure to change, whether in individual client, corporate banking or capital markets businesses,», they indicated. «We can't really make a deeper assessment at this time.»

Raiffeisen Switzerland also wants to wait to see how things pan out. A spokesperson said that anything that helped to ensure stability while quietening the current situation down for the Swiss finance hub as a whole is a welcome step.

Attractive for Individuals

When it comes to market share, the current number one in the Swiss mortgage business remained positive. «We remain attractive for many different kinds of clients with a business model that is domestically focused, strongly anchored regionally, and organized as a cooperative», the Raiffeisen spokesperson continued.

Large Steamroller

It is indeed not all that clear if the red and blue steamroller will flatten all of its domestic competitors. On paper, their power looks impressive.

But the project to bring both institutions together has to prove itself in the market and a number of hurdles stand in the way.

Even together, the two banks are not the first choice for most Swiss. As a joint domestic survey showed last spring, the cantonal banks are the clear leaders in the home market or the ones that most clients use.

The cumulative share of UBS and Credit Suisse was about 19 percent and recent estimates indicate that the fused entity could potentially lose clients as many clients generally like to divide up their assets at various banks as a risk mitigation measure. Their retail networks also have large overlaps and both have been paring the number of branches in recent years. The transaction is likely to bring another wave of closures, giving other banks far more breathing room.

Tight Labor Market

Getting rid of branches will prompt job cuts. If front-line staff is let go, they are going to try to bring the clients along with them to their new employers. Those former competitors are likely to meet them with open arms as local banks have been contending with a tight labor market for many years.

But the demand will not take up all the slack from the jobs that may be cut, with BAK-Economics making an initial estimate that the deal has the potential to rationalize 9,500-12,000 jobs.

Shaken to the Core

All the uncertainty related to Credit Suisse has shaken the retail client base to its core. The bank's 2022 annual report shows that the bank saw an outflow of almost $20 billion in 2022 in Swiss savings deposits.

Since then, the total size of the bank's balance sheet has shrunk further while the recent turbulence is likely to have increased the pace of withdrawals.

Given all that, it is possible that the assumptions of Colm Kelleher and Ralph Hamers made when the slides were drafted are already starting to look outdated.