Selling prices for second-hand luxury watches have performed well over the long term. The best models are more interesting than ever.

Stock market turmoil, banking crises, recession fears. It's no wonder investors are looking for alternative and stable-value investment opportunities these days. Amidst gathering storm clouds in the economic sky, investors are above all looking for investment opportunities with characteristics such as robustness and durability to weather a possible recession.

Luxury watches in particular have been, and continue to be, a sought-after alternative form of investment. In some cases, high premiums are paid for used models of the top brands. Particularly in demand are timepieces from Rolex, Patek Philippe, and Audemars Piguet, along with leading independent manufacturers such as F.P. Journe and De Bethune.

Indispensable for Collectors

For collectors looking for rare and special watches, the second-hand market is indispensable. Nearly 95 percent of watches are no longer manufactured. And the resale value usually increases for hard-to-find models of coveted brands.

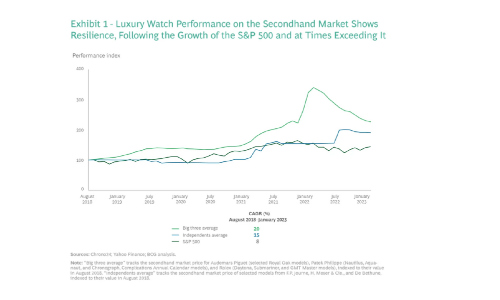

Given their scarcity, many investors expect the value of second-hand luxury watches will continue to rise, and with good reason. Luxury watches have so far yielded rich returns, especially over the long term, a recently published analysis from the Boston Consulting Group (BCG) shows.

Better Than Jewelry, Wine, and Art

Buyers view the category as a stable investment based on famous brands and supported by a customer base of high-net-worth individuals. Over the decade from 2013 to 2022, watches outperformed collectibles such as jewelry, handbags, wine, art, and furniture, with an average annual appreciation of 7 percent, according to BCG.

To be sure, retail prices for high-end watches on the second-hand market have also seen a price correction in the past year in the wake of slumping cryptocurrencies and tech stocks. But compared to traditional asset classes, they have performed well, especially from a longer-term investment perspective and despite market downturns.

Attractive Returns

From August 2018 to January 2023, average prices in the pre-owned market for top models of the three largest luxury brands, Rolex, Patek Philippe, and Audemars Piguet, rose an average of 20 percent annually. Prices for a basket of so-called independent brand watches, including F.P. Journe, H. Moser & Cie, and De Bethune, climbed 15 percent per year over the same period.

(Click on the graphic to enlarge. Source: BCG)

According to BCG, luxury watch prices outperformed the S&P index even during the 2007-2009 recession. And they took less than two years to recover from the 2008 market crash, while many traditional financial categories endured a much longer dry spell. According to the BCG specialists, investor attention is focused on a handful of models, including Patek Philippe's Nautilus, Audemars Piguet's Royal Oak, Rolex's Daytona, and GMT-Master II.

Given the growing interest among buyers and the shortage of the best models, buying interest is likely to remain strong in the future, especially since luxury watches are both fashion and status symbols and are admired for their craftsmanship. Will such an investment pay off? Only time will tell.