Visitors to the upcoming Zurich Art Weekend might end up talking less about the artwork hanging on walls and more about «the interaction between the art world and the general public,» Mirabaud’s Zurich head, tells finews.com in an interview.

With over 100 events, the key to this year’s Zurich Art Weekend is «the dialogue between the artist, the audience and institutions» Mirabaud’s Zurich head and art lover Michael Hoesli, tells finews.com in an interview.

Besides the interaction, the international reach both in terms of collectors and exhibiting artists also sets this edition apart from previous versions, he says.

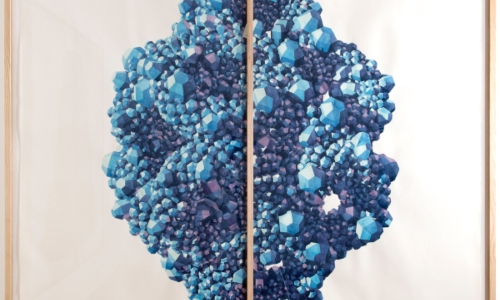

Mirabaud, the festival’s main sponsor, invites the public to discover part of its house-owned collection virtually, which includes a piece from the contemporary Cuban collective Los Carpinteros (image below) and photography from deceased US artist Robert Mapplethorpe, although none of the latter's controversial works.

Los Carpinteros, Polen Hexagonal Azul, 2016 (image: Mirabaud Collection)

Like many galleries and museums, Mirabaud made its art collection available online during the COVID pandemic. Digitization during that period «fostered the interest in art among the public,» making it accessible to a wider audience, Hoesli says.

In an unexpected development, that may have paved the way for NFTs. Although the trend «with its price volatility» is something Hoesli, a small-scale art collector himself, has observed and followed, he admits to struggling to «relate emotionally to a token stored remotely.»

Robert Mapplethorpe, Y Portofolio, 1978 (image: Mirabaud Collection)

He is, however, keen on some of the video art being created at the moment. With feeds from the art festival going to Instagram, Linkedin, Facebook, and Twitter, the Zurich Art Weekend is also a way for the private bank to engage with its younger generation.

Twitter & Co.

While the communication channels to younger clients have changed, «there is no change in the relationship. The next generation requires as much personalized service as their parents and grandparents,» Hoesli says.

To bring its client service in line with the demands of the younger generation, the private bank has been working with banking software provider Temenos, on a new digital platform currently being implemented. Otherwise, everything is done in-house.

The private bank has never acquired another business but has grown organically over seven generations. Today it is headed by four partners: CEO Camille Vial, Nicolas Mirabaud, Yves Mirabaud, and Lionel Aeschlimann, the first three belonging to the founding family.

Talking to Relationship Managers

Its «family-owned long-term focus» is a selling point to relationship managers looking for a new home from larger banks, Hoesli says. Mirabaud is in «active discussions with individuals and teams» from larger banking groups including Credit Suisse, he adds.

Mirabaud is increasingly in discussions with ultra-high-net-worth families that have relationships both with Credit Suisse and UBS and who are worried about «putting all their eggs in one basket.»

Otherwise, the turbulence around the takeover has had little effect on the brokerage, asset management, and private banking services Mirabaud offers from its booking centers in Switzerland, Dubai, Canada, and Luxembourg.

With over 31 billion Swiss francs under management the bank’s clear focus on its family office-type service, «naturally speaks to a different type of client,» than those who go to larger rivals, Hoesli says.

Market Size

Since joining as Mirabaud’s Zurich branch head at the end of 2019, Hoesli has seen the bank’s local market presence nearly double. The Zurich business, with just under 50 employees, has a strong focus on LatAm and is seeing increased demand from another region.

Concerned by the war in neighboring Ukraine, «many Polish individuals and other EU citizens saw the need to diversify risk,» Hoesli said. Russia, however, was never a key market for the private bank, he adds.

Given all the events that have hit Switzerland’s financial industry over the past 16 months, from the adoption of Russian sanctions to the government-orchestrated bailout of its second largest and globally systemically relevant bank, for Hoesli, the Swiss financial center has not ceased to play an important role as a «safe haven.»

Haven For Art

It is a haven that also allows one to enjoy art.

While reluctant to classify art as an asset class, Hoesli acknowledges that strategies exist to increase the value of one’s collection, «I always advise clients to purchase what they love,» he says.

And if what you love proves to be a great investment, then so much the better.