The financial industry is exploring new ways to bring providers and customers together. In Zurich this week, a «beauty contest» was held to see who was the most desirable at the end.

To describe an independent investment strategy in seven minutes is no child's play, but in today's investment environment, it's a skill demanded of asset managers and banks. This was recently on display at this week's inaugural Wealth Office Conference hosted by Zwei Wealth in Zurich.

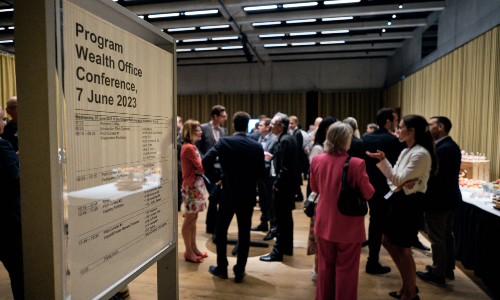

Moderator and Zwei Wealth Partner Cyrill Moser (all images Benjamin Ackle, Zwei Walth)

Founded in 2014, Zurich-based Zwei Wealth is active in wealth management consulting, using a digital platform matching investment offers from selected banks and independent asset managers with potentially interested parties. By optimizing supply and demand, the company says it achieves significant improvements in returns and cost savings for clients.

Hundreds of Firms Competing

To live up to its quality standards, Zwei Wealth reviews the offerings of some 500 financial institutions according to several criteria, including track record, costs, and offering quality. A provider rating is a recent addition.

Other factors considered are the providers history, assets under management, number of employees, specialization, ownership structure, and possessing necessary licenses. Two-thirds of the providers managing around 6.2 billion Swiss francs meet the criteria.

120 Guest Judges

To escape the virtual world, Zwei Wealth launched the inaugural conference this year, CEO Patrick Mueller told finews.com. At this week's event in Zurich, around 120 guests rated the performance of 21 independent wealth managers and banks on a scale of one to five on their cell phones following a seven-minute presentation.

Offerings ranged from relatively mundane fixed-income strategies, appealing in the current interest rate environment, to sophisticated scientific investment concepts and digital impact investments.

Customer Inquiries

With such presentations, the industry is breaking new ground and illustrating what clients demand most today: transparency, independence, and cost awareness, all at the touch of a button is possible. These demands are contained in a new report from Zwei Wealth measuring and analyzing customer satisfaction, returns, risks, and costs.

The platform and the presentation in a speed-dating format, if you will, in front of a large audience is a new and unconventional way for providers to attract potential clients, the representative of a Swiss private bank told finews.com. In the past few days alone, he received around 20 customer inquiries worth a total of 20 million francs stemming from the event.

The Best Providers

While the organizers announced the top three providers, Zwei Wealth kept the remaining ratings to themselves. In third place was independent asset manager Hérens Quality Asset Management (HQAM) with a 20-year track record of investing in companies based on fundamentals.

Three providers shared the second step of the podium. Private bank LGT for its investment portfolio and J. Safra Sarasin for its dividend strategy in recessionary times. The other was Ticino-based asset manager Lapis Asset Management, which presented a strategy for investing mainly in large dividend-paying companies.

Crowdlending Platform as the Winner

The clear winner of the contest was Swisspeers with a score of 3.9 in the voting rating (maximum score 5). This is an independent crowdlending platform that allows companies to raise debt capital from investors directly – i.e. without the intermediary of a financial institution. This peer-to-peer financing aims to create a simple and transparent alternative to traditional bank loans.