Private banking group Reyl Intesa Sanpaolo acquires Swiss Carnegie Fund Services which offers foreign asset managers access to the Swiss market.

Swiss-Italian private bank Reyl Intesa Sanpaolo bought Carnegie Fund Services which represents over 100 global investment managers and some 700 funds in Switzerland, according to a statement Monday.

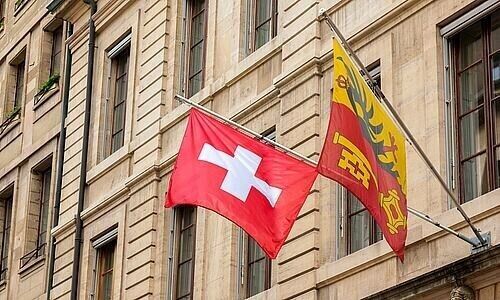

Founded in 2003, the Geneva-based firm serves clients including fund companies, boutique firms, and large global asset managers in Europe, North America, Asia, and Australia.

Client Base Integration

The acquisition is meant to strengthen Reyl's Fund Representation Solutions (FRS) division, which provides Swiss representation and paying agent solutions for some of the world's largest asset managers.

By integrating Carnegie's expertise and client base, FRS will significantly expand its market base while consolidating its position as a partner for customized wealth services. At the same time, Carnegie's clients will gain access to Reyl's banking infrastructure

«Carnegie is recognized as one of the founding fathers of fund representation and distribution in Switzerland. We are thrilled to become part of REYL, a powerful and innovative banking group that will open the next chapter of our development,» Carnegie CEO Alexandre Pini said of the deal.

The integration will be led by Colin Vidal, head of business development at FRS, and Philippe Steffen, head of operations. Financial details about the company were not provided.