The Swiss financial industry used to benefit from true role models who regularly spoke their minds and made the general public aware of the importance of banks for the country. Over the past 15 years, this tradition has been lost. Who are the most important opinion leaders in banking today?

Over the decades, various personalities have shaped the reputation of the Swiss banking industry. To this day, they're regarded as figureheads and leaders for a guild dependent on such role models because of their delicate and discreet activities, but at the same time so important for Swiss prosperity.

Alfred Sarasin, Alfred Schaefer, and Robert Holzach come to mind as do Claude de Saussure, Ivan Pictet, Patrick Odier, and Konrad Hummler to name a few.

What they have in common is that beyond their prominence in the banking industry, they spoke out and became involved in socio-political, philosophical, or even cultural issues. They lent a human face to an industry that is per se addicted to filthy lucre. They succeeded in making the general public understand the great importance of the financial sector for our country.

Social Media as a Risk

(Image: LinkedIn)

Over the past 15 years, this tradition has visibly faded. Opinion leaders in Swiss banking have become sparser partially because there are more foreign CEOs. But especially in the wake of the global financial crisis of 2008, the focus has been on the core business.

The rapid spread of social media and the risks associated with it, combined with the debate about political correctness and the resulting pitfalls, meant that bank CEOs were understandably reluctant to speak out on general issues. As the example of former UBS CEO Ralph Hamers shows, a CEO couldn't please everyone. By engaging with the LBGTQ+ community in public (image above), he earned great acclaim in some circles, while in others he was met with incomprehension.

Long-Term Damage

Understandably, bank CEOs are taking themselves out of the firing line, especially since their main task is the successful management of a financial institution. Nevertheless, the desire for role models and credible, authentic representatives from the financial sector is greater than ever, especially since the debacle surrounding Credit Suisse. This recently came to light in the survey on career prospects in the Swiss financial sector conducted by finews.com.

One in four bank employees believe their profession has suffered reputational damage «for a long time to come.» For the industry's reputation to improve again, 44 percent of those surveyed say real role models are needed in the executive suites.

But who are these role models? Where and how can they be identified? finews.com addresses these questions and presents a highly subjective list of the new opinion leaders in Swiss banking.

Last Major Swiss Bank

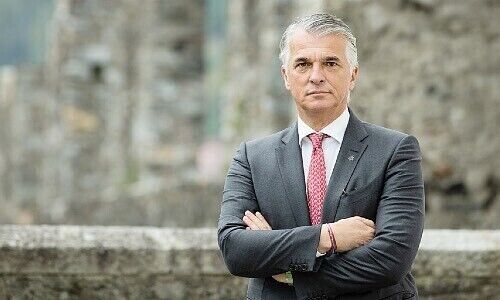

(Image: Keystone)

UBS is aware Sergio Ermotti (image above) is undisputedly the most important opinion leader in the Swiss financial industry and immediately recruited him as CEO for its task of the century. UBS board vice-chairman Lukas Gaehwiler (image below) is nearly as important. As liaison to the authorities and politicians in Bern, his public statements carry weight, especially in the aftermath of the 2008 global financial crisis when helped the beleaguered UBS (Switzerland) regain its reputation.

(Image: UBS)

As representatives of what is now the last major Swiss bank, Ermotti and Gaehwiler must weigh their words carefully out of consideration for sensitivities abroad. UBS not only has many weighty foreign shareholders but also depends on having the best possible relations with the governments and authorities in the world's most important financial centers. In this respect, the representatives of the Swiss private banks have it easier.

Russians Under General Suspicion

(Image: zvg)

They can be more outspoken, as seen at the recent Private Banking Day in Basel. Private banker Grégoire Bordier (image above) was particularly harsh in his criticism of Switzerland's sanctions policy toward Russia, which in some cases places the entire Russian population under general suspicion. «I am thinking of the limitation of deposits to 100,000 euros for many Russian citizens and residents, a measure that neither the United States nor the United Kingdom has adopted and which therefore has only negative effects,» Bordier said. Against this background, he demanded Switzerland develop an independent sanctions strategy.

These are words that few bank representatives express so clearly in this day and age, at the risk of making more enemies than friends. But Bordier's decisiveness fits into the great tradition of his predecessors such as Sarasin, Holzach, and de Saussure.

Communicating With Confidence

(Image: Julis Baer)

Philipp Rickenbacher (image above), head of the Zurich-based private bank Julius Baer, isn't at a loss for a clear opinion. He has a social media presence like few other colleagues of his rank. He comments on every conceivable topic, from the EU to jazz, technology, art, literature, and gender equality.

He deserves credit for the fact that his content is prepared in a highly professional manner and has substance. He's not afraid to express his opinion in front of a large audience. At the Private Banking Day, he said «The events surrounding the bailout of Credit Suisse have understandably caused a stir. But the facts are complex.» It's therefore important that «we also communicate this more clearly and confidently to the broader general public abroad.» Rickenbacher aimed criticism at Bern, saying that the sense so far is there is little motivation to rebuild the damaged reputation of the Swiss financial center.

In the Service of the Finance Minister

(Image: Pictet)

Pictet partner Renaud de Planta (image above) sets a good example, having recently joined Federal Councillor Karin Keller-Sutter's group of experts on banking stability, as the only representative of his profession. That he's taking this on in addition to his work as a senior partner in a private bank is highly commendable from an industry perspective. At the same time, he has an important function in this role as an opinion-maker on the stability of the local financial industry.

(Image: Vontobel)

Zeno Staub (pictured above) is another banker who may be making his way to Bern next year. A few months ago, he surprisingly announced his resignation as CEO of investment firm Vontobel effective April of next year. He intends to serve as a representative of the «Die Mitte» centrist party in the National Council, provided he's elected this fall. With his track record as a long-standing bank manager, he undoubtedly brings with him the necessary tools. It remains to be seen whether Staub, a brilliant thinker, can make himself heard with his differentiated opinions in Bern's increasingly polarized political circus.

Unique Window of Opportunity

(Image: EFG)

In general, clear statements can only be heard from very few top bankers these days. They tend to get carried away with growth fantasies and platitudes about the customer orientation of their institution. In contrast, EFG Chairman Alexander Classen (image above) offers clear opinions.

In a recent interview with the Geneva daily «Le Temps,» he spoke bluntly about the unique window of opportunity available to poach first-class client advisors from Credit Suisse. No other top banker has so honestly acknowledged what, in principle, the bulk of all banks in this country are now doing.

Trendy Term NextGen

Experiences in recent years with Covid, accelerated digitization, higher interest rates, retiring baby boomers, and the emerging Generation Z shows the Swiss banking industry can only have a future if it completes the generational change. This comes at a time when the banking profession has massively lost its appeal for graduates unless it has to do with data, IT, or ESG. There, too, new opinion leaders are needed.

Even though most banks are now emulating the trendy term «NextGen,» few know what it means. One thing is certain: it won't be total digitization says 34-year-old private banker Jay Bidermann, recently named a partner at Zurich-based private bank Rahn+Bodmer.

«We Are the Concierge»

(Image: Rahn+Bodmer)

«The next generation of clients will think differently. They will use digital channels to keep track of their assets. But it should never get to the point where our advisors tell clients they can handle an order themselves via the app. That would be retail banking, and we certainly don't want that,» Bidermann (pictured above) recently explained in an interview with «Finanz und Wirtschaft» (in German, behind paywall). With his view of private banking, he succeeds quite well in defining the future of his profession. «We are the concierge, we never say do it yourself via the app.»

Between Platitudes and Slogans

(Image: Havilland)

A clear opinion in the tradition of former banking personalities is also regularly expressed by 36-year-old Fabian Kaeslin (pictured above). The CEO of Banque Havilland in Liechtenstein and Switzerland aptly sums up the potential of the local financial sector declaring to finews.com that «The demise of Credit Suisse shouldn't just be seen as a tactical opportunity to poach clients and employees, but much more as a long-term and strategic return to small is beautiful.»

While anonymously-owned major banks struggle with internal politics, silo thinking, and endless PowerPoint battles, small and medium-sized banks are often controlled by strong entrepreneurial personalities, flexible and customer-focused, he said. «If a big bank is only concerned with sending out politically correct platitudes and airy hold-out slogans, but loses sight of its basics, then it comes as it has come,» Kaeslin, as one of the new opinion leaders in Swiss banking, puts it in a nutshell.