It's mainly the bigger banks making the headlines in the Swiss financial industry. Measured performance, it's primarily smaller institutions that offer clients the greatest value, a first-time study made available exclusively to finews.com, shows.

The Zurich University of Applied Sciences (ZHAW) analyzed 69 Swiss financial institutions offering wealth management services, examining twelve figures divided into four categories: profitability, efficiency, capitalization, and growth. «Wealth Management in Switzerland» shows practically all top performers are smaller institutions.

That suggests smaller financial institutions are better or more consistent with their respective strategies, positively impacting efficiency and profitability. Some of these «micro-banks» rank among the top three in several categories.

Strong Entrepreneurial Personalities

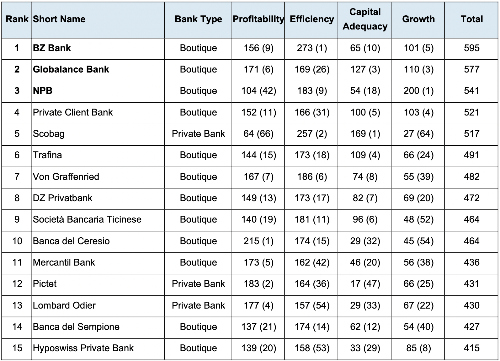

BZ Bank, founded by financier Martin Ebner and now owned by Graubuendner Kantonalbank, tops the overall ranking, followed by Globalance Bank and Neue Privat Bank (NPB), the latter of which is based in Zurich.

(Click image to enlarge)

As different as the three institutions are, there's a common thread. They were shaped by the strong entrepreneurial personalities of Ebner, Reto Ringger, and Markus Ruffner. With their respective strategies of equity trading/brokerage, sustainability, and tailored investment expertise, they have differentiating features, are efficient, and capital-strong due to low costs. That places them well to achieve good growth.

Classic private banks top the profitability rankings as measured by return on total capital, return on equity, and return on AuM. Their business isn't particularly capital-intensive, but at the same time, they have high equity capital. That's in line with the expectations of wealthy private clientele (ranking below).

(Click image to enlarge)

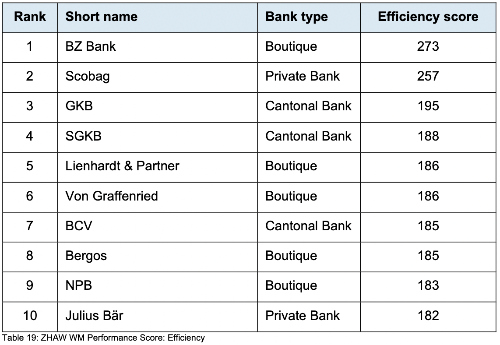

In terms of efficiency, it's mainly smaller banks or institutions having significantly lower costs and high profitability, primarily due to their geographical location outside the major Swiss financial centers that come out on top (ranking below).

(Click image to enlarge)

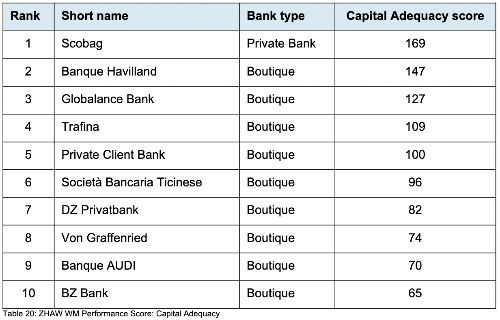

Owner-managed institutions in particular rank in the top group, thanks to their high capital adequacy, and above-average CET1, leverage, and liquidity coverage ratios. Partner-managed banks can afford higher equity because they're not subject to pressure from external shareholders (ranking below).

(Click image to enlarge)

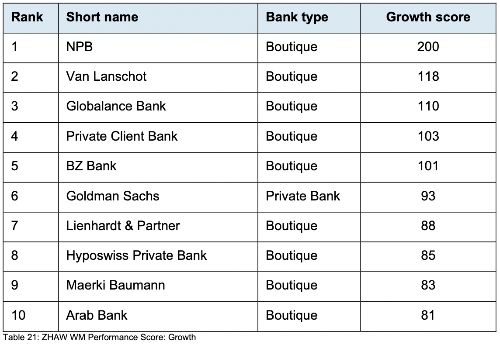

The study's authors derive the growth score from classic asset figures like net new money, development of assets under management, and the number of employees, helping determine whether growth is profitable or merely «turnover boasting» (ranking below).

(Click image to enlarge)

Lean, Male Boards of Directors

The study examined the boards of directors of the banks and found many have only five or six members, indicating they prefer a lean board structure.

Despite numerous efforts, women continue to be underrepresented, with nearly 40 percent of the boards having no women. In 80 percent of the companies, the proportion of women on the board is below 30 percent.