Until recently, small Swiss private banks appeared to be doomed. But within a few months, the situation has changed dramatically. They're heading for record results, and takeover talk has faded. What happened?

For small Swiss private banks, 2023 has been an extremely successful year. Gross profits almost reached the level of last year, according to a mid-year analysis private bank study from KPMG made available to finews.com. The interest rate environment was a decisive factor, leading to a marked shift in the earnings structure of private banks away from the commission business and towards the interest business.

This is particularly evident among the small banks. Their commission business accounted for 58 percent of total income in 2021, which fell to 41 percent this year, whereas the share of interest income increased from 24 percent to 41 percent. This is reflected in the cost/income ratio (CIR), which improved 13.3 percentage points at the small banks, from a median of 78.6 percent to 65.3 percent.

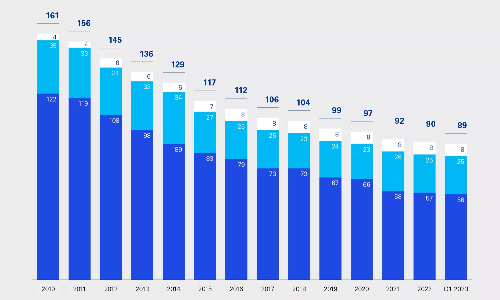

Number of Swiss Private Banks by Size

(To enlarge, simply click on the graphic)

M&A Activity Slump

By comparison, mid-sized private banks could only reduce their cost/income ratio by 7.4 percentage points to 74 percent. In contrast, the «Big 8»(1), which includes Julius Baer, Pictet, and Vontobel, could only reduce their cost/income ratio by 1.3 percentage points to 67.3 percent. The improved results of the small private banks led to a significant decline in M&A activity, KPMG's other figures show.

With only two transactions through the first nine months of this year, excluding UBS's acquisition of Credit Suisse, private bank mergers and acquisitions came to a virtual standstill compared to 15 last year. Reyl acquired Carnegie Fund Services, a Swiss fund representative, in June, and UBP acquired Angel Japan Asset Management with 1.1 billion Swiss francs of assets under management. The situation is expected to continue until early next year, according to Christian Hintermann, a banking specialist at KPMG Switzerland.

Record Results Expected for the «Small Ones»

A significant reason is that many private banks are trying to profit from the integration of Credit Suisse into UBS by hiring client advisors or even entire teams.

For the full year, KPMG expects record results, especially from small private banks, as they continue to benefit the most from the interest rate situation. Nevertheless, it shouldn't be ignored that volatile financial markets, as has been the case in the second half of the year, will hurt the core business of assets under management and commission income, the analysis continues.

1The «Big 8» include Edmond de Rotschild, EFG International, J. Safra Sarasin, Julius Baer, Lombard Odier, Pictet, UBP, and Vontobel. However, Lombard Odier and Edmond de Rothschild were not included in the analysis as no half-year figures were available from them in time.

In this Private Banks Update, KPMG examined the half-year results of 37 private banks operating in Switzerland. This represents 42 percent of the population of 89 Swiss private banks. This update does not include data on assets under management (AuM) and net new money (NNM).

The current analysis of 37 banks omits many of the weak performers in 2022, as they have not published their half-year results for 2023. The survey also excludes UBS, Credit Suisse, and banks in liquidation.