UBS earnings released last week included Credit Suisse for the first time. In the integrated wealth management business, Switzerland and Asia now account for a larger share of the overall business.

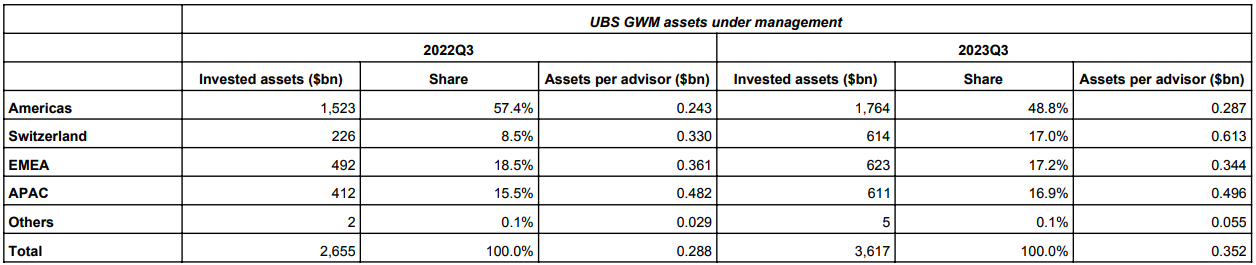

In the third quarter of 2023, UBS reported its earnings for the first time with the inclusion of Credit Suisse figures. Within the wealth management unit, invested assets grew $962 billion year-on-year to over $3.6 trillion (including market performance) while the number of advisors increased by 1,048 to 10,278.

The rise was not evenly distributed and the rankings of geographies have been reshuffled, according to finews.asia analysis, with the region recording an increased share.

Invested Assets

While the Americas and EMEA retained their top rankings, both regions accounted for less overall assets. The Americas ($1.7 trillion) and EMEA ($623 billion) both saw their share of total invested assets shrink from 57.4 percent to 48.8 percent and from 18.5 percent to 17.2 percent, respectively.

Switzerland saw the largest change in share. Invested assets surged $388 billion to $614 billion while the market's share doubled from 8.5 percent to 17 percent, boosting it to become UBS’s third largest market. The increase includes assets from global financial intermediaries, such as external asset managers, transferred from EMEA and APAC for alignment to the new management structure.

APAC was the other market to see its share rise, from 15.5 percent to 16.9 percent as invested assets soared $199 billion to $611 billion, though its ranking fell from third place to fourth place at just $3 billion behind Switzerland.

Front Office Headcount

In terms of manpower, the Americas saw the total number of advisors fall 115 to 6,142, accounting for 59.8 percent of the worldwide total.

Meanwhile, Switzerland and Asia’s share rose to 9.7 percent (318 advisors added) and 12 percent (377 advisors added), respectively. EMEA was the only market to see its share of invested assets shrink while its share of advisors grew to 17.6 percent (447 advisors added).

Wealth Per Advisor

As a result, the average amount of invested assets per advisor rose from $288 million to $352 million.

Switzerland was the leader in this metric with $$613 million per advisor – a whopping year-on-year addition of $282 million. This was followed by $496 million per advisor in APAC ($14 million increase), $344 million in EMEA ($17 million decrease) and $287 million in the Americas ($44 million increase).

- The figures above are based on published reports of quarterly earnings