Traders all across Europe are complaining about a massive liquidity problem on the public stock exchange. On the other hand, so-called dark pools for block trading that is invisible from the outside are booming.

The professionals at the trade desks of European banks and securities companies are worried. According to a survey conducted by SIX Swiss Exchange, almost half of them are complaining about the low levels of liquidity in securities trading.

Every fourth person surveyed would also like to see more volatility.

Stagnant Inactivity

Investors have been the subject of complaints for months, not least by local financial institutions and fund managers, and their inactivity is also making life difficult for traders. SIX conducted the «Trader Survey» in the third quarter of this year, and reached 2,000 traders from Switzerland, France, Germany, the U.K. and Ireland, the Netherlands and Liechtenstein.

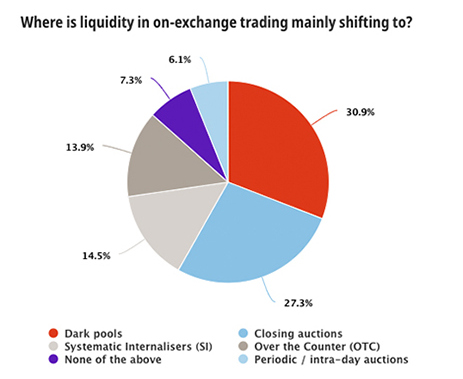

Those surveyed reported that traders are flocking towards «dark trading» because it is hard to do anything anymore on the public, regulated exchanges. For example, the survey revealed that the trading activities on the regulated exchanges are either shifting to dedicated, closed platforms, such as dark pools for blocktrade, or to over-the-counter (OTC) markets.

Public order books at a disadvantage

Almost one-third of the survey participants thought that the liquidity that is diminishing in ongoing exchange trade is most likely to flow into the dark pools. SIX concludes that trading platforms that offer a wide variety of order books and execution mechanisms are therefore clearly better positioned than those which only offer trading in the public order book.

(Source: Six Group)

This must give us pause for thought because the dark pools have a mixed reputation. After the financial crisis of 2008, the critical voices became ever louder, asserting that large businesses distorted the market and obtained better prices via dark pool trading than participants in public markets. At that time, there were concerns about the supposed high volumes traded on such platforms.

Obscure High-Speed Deals

American journalist and author Michael Lewis dragged the debate into the spotlight in his bestseller «Flash Boys». In the book, he describes the obscure role of dark pools in high-frequency securities trading. Regulators in Europe also took action against the platforms and restricted their market area – evidently without any lasting effect, as is now becoming apparent.

«The growing interest in these alternative trading mechanisms follows the introduction of the second European Union directive on markets in financial instruments (Mifid II) which came into force in 2018 and was intended to shift trade flows onto transparent trading platforms», the SIX study determines.

«This Serves No One»

At SIX, there are now concerns about the trend as well. «Alternative trading mechanisms facilitate various interactions in order to achieve different results», commented André Buck, head of sales at SIX Swiss Exchange, on the findings of the study.

«However, if this is done solely at the expense of the public order books, this serves no one. Fair and transparent pricing is the cornerstone of liquid markets», according to Buck.