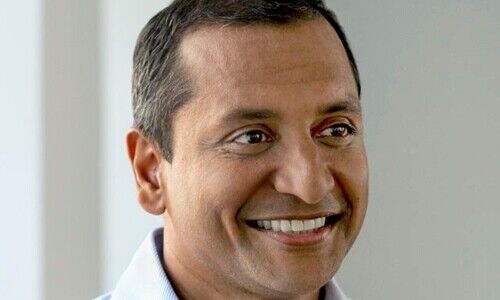

Robert «Bobby» Jain made a real fortune at Credit Suisse. Whilst the CS has gone down, the American is now getting started with his own hedge fund.

Robert Jain is launching his own hedge fund on the market under the name Jain Global in July 2024. And the superlatives are already being circulated: experts are expecting this to be the biggest ever market launch of a hedge fund. Some are anticipating starting capital of up to 10 billion dollars, as agency «Bloomberg» (paid article) reported.

Dozens More Fund Managers Needed

Jain Global is also expected to add no fewer than 40 portfolio managers to the 50 existing employees before the market launch. Owing to the complicated raising of finance, the company is offering a «perpetual» discount on performance fees – as of a minimum commitment of 250 million dollars.

Hedge funds often demand high performance fees in addition to management fees. The industry standard is traditionally a 2 percent management fee and 20 percent performance fee, a so-called «2 and 20» structure.

The Jain-Shafir Combo

Jain spent a total of 20 years working at Credit Suisse. There, he succeeded Robert Shafir as the global head of asset management, before he turned his back on the institution in 2016. The Jain and Shafir combo had pushed the hedge fund business at CS, and in doing so, sealed a number of deals which later did not live up to expectations.

For example, the takeovers of the two highly-paid managers included York Capital Management, a hedge fund for which CS had to write off 450 million dollars at the end of 2020. Setbacks like these became more and more frequent in the years to follow, and contributed to the series of losses which finally culminated in the bailout of CS in March 2023.

Successor Stumbled on Greensill Scandal

Eric Varvel, Jain’s successor as global head of the CS fund business, stumbled on the forced closure of the CS Greensill fund and had to resign from the major bank at the end of 2021.

His predecessor showed much better timing. After his time at CS, Jain became chief investment officer at the hedge fund Millennium Management, founded by Israel Englander, one of the biggest and most successful players on the scene. Jain may now be able to put the Millennium fame to good use for his own company.