Swiss independent asset managers are going to need hundreds of new client advisors in the next few years, according to a new survey. This will further complicate the sector’s relationship with banks.

Currently, private banks and their mass recruitment of client advisors are at the center point of discussion, especially former Credit Suisse employees. But this could change in the future. Financial SMEs will also increasingly be competing for the best talent in the industry according to «Strategische Weichenstellungen» (Setting the Strategic Direction), a new industry survey on the Swiss market for independent asset managers (EAMs), which was published on Friday.

The survey was conducted by consultancy Advea and holding company Cinerius. Cinerius is active in both Switzerland and Germany as a consolidator of independent asset managers. The study’s participants were Swiss EAMs of various sizes with a license from the Swiss Financial Market Supervisory Authority (FINMA). In-depth conversations were also held with more than 50 industry players with a total of 48 billion Swiss francs under management.

«War for Relationship Managers» Looming

According to the survey, the medium-term scenario is that EAMs will need more than 1,000 new client advisors in the next three years. And they want to poach the majority of them from banks. The authors of the study expect this to lead to a «war for relationship managers» between EAMs and the banks.

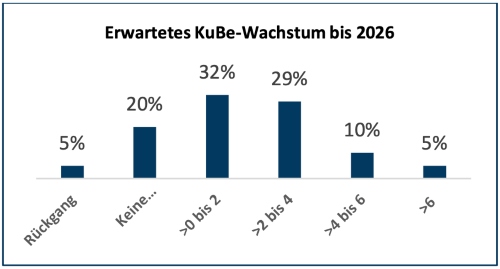

Expected client advisor growth by 2026 (Figure: Cinerius)

The EAMs surveyed all reported growing headcounts. One in three of the firms surveyed also intends to hire up to two new front-office staff in two years (see figure above). This reflects that independent asset managers have to some extent already responded to the changes in the banking sector.

Private Banks Expected to Take a Hit

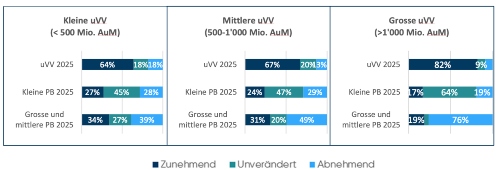

The survey’s respondents expect EAMs’ market shares to grow at the expense of large and medium-sized private banks (see figure below). For example, half of the survey participants expect financial institutions, which are important as custodian banks but are also EAMs’ primary competitors, to lose market share when it comes to providing advice to wealthy clients. In particular, the large EAMs, which have more than 1 billion Swiss francs in assets under management want to poach client advisors from medium-sized and large private banks.

In line with this fact, 71 percent of the EAMs surveyed are self-confident and expect their own market share to grow by 2025. This will be at the expense of small, medium-sized and large private banks. According to the report, 17 percent of respondents are expecting the situation to remain stable and only 12 percent expect business to shrink.

Estimate of the changes in market shares by 2025 (Figure: Cinerius)

EAMs Must Not Stand Still

According to the report, EAMs’ chances in the competition for front office staff are not bad. Survey respondents state that banks’ lack of flexibility and outdated product and pricing policies, for example, encourage the switch to independent asset management. In addition, survey participants say that EAMs focus better on clients and have a de facto independence.

The study’s authors see the increasing competition between EAMs and banks as positive. The change is important for the industry’s success. However, independent asset managers will need to continue working to create attractive working conditions and an entrepreneurial environment to attract client advisors from banks.