Imagine a world where fine art can be enjoyed as effortlessly as the luxury of a leased car. This vision encouraged former finance professional Bruno Thalmann to establish a company that opens new horizons for art lovers and investors.

What if acquiring an artwork was as straightforward as leasing a car? This exact question was pondered by Bruno Y. Thalmann (pictured below) before he founded the company Art Leasing & Invest in 2005. Since then, his approach has challenged the market and offers solutions that are appealing to both collectors and financiers.

Thus, Thalmann provides an art leasing model for an open art market. Furthermore, it becomes possible to acquire art in a way that conserves liquidity and offers benefits: leased artworks are tax-deductible for companies.

Bruno Thalmann (Image: LI)

«Leasing art had something reprehensible about it in the scene about 15 years ago, either you could afford a work, or you preferred to do without», Thalmann explains. Despite skepticism, the art leasing model has since carved out its place. Thalmann, a former financial advisor, speaks both the languages of art and finance and has managed to unite both worlds in a unique business model.

How Does Art Leasing Work?

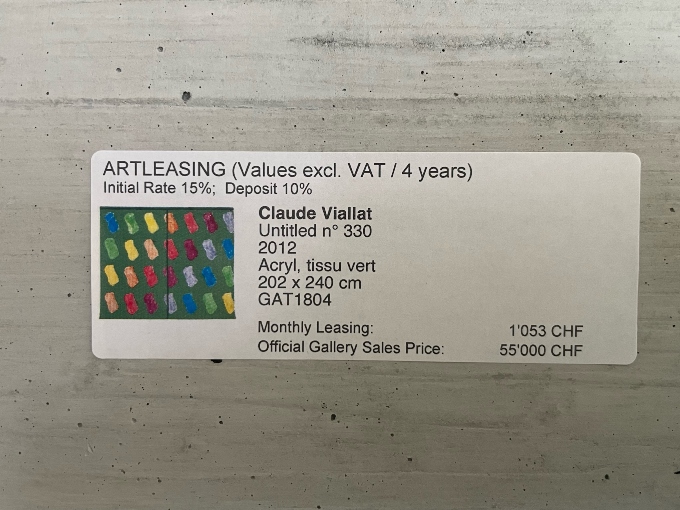

Lease conditions for an artwork by Claude Viallat (Image: finews.art)

The flexibility of the lease agreement, which lasts between three to four years, is a key component of his offering. After two years, clients can then decide whether they want to keep the artwork or exchange it for a new one. The monthly installments are tied to the artwork's sale price and it is fully insured during the term.

Thalmann's partners are renowned national and international galleries. Often, the clients themselves decide which masterpiece they wish to lease. The art leasing company then initiates discussions with the relevant gallery and finalizes the contract.

Profits for the Lessee

One of the biggest advantages of the model is that the lessee is enjoying a share of any appreciation in the artwork's value during the leasing period. Even with an increase in value of the underlying masterpiece, the lease remains unchanged, allowing the lessee to profit from a kind of implicit discount.

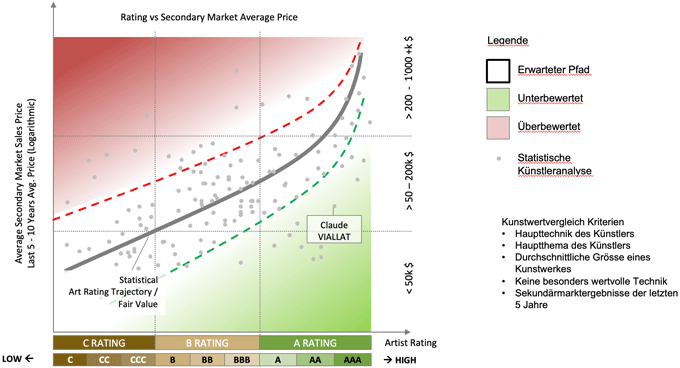

Market performance in relation to Artist Rating (Click image for a large view, Image: Art Leasing & Invest)

Auction Leasing and Art Rating

In addition to ArtLeasing, the company offers Auction Leasing in collaboration with auction houses and a bespoke valuation method labelled Art Rating based on an objective analysis of 70 KPIs. This analysis evaluates the respective artists, their past success, visibility, tradability, and ability to complete projects on time and within budget, thus incorporating a broad analysis beyond the artwork itself.

Thalmann's system, which categorizes artists from AAA (outstanding) to D (not yet established in the market), provides a transparent basis for purchase decisions or art investments.

Solid Foundation for Investment Decisions

The significance of this rating extends far: It offers decision-makers, who may not understand much about art, a solid foundation for investment decisions. In contrast, experienced art collectors benefit from an impartial confirmation of their assumptions.

For larger projects, the artist rating serves as a rationale for inclusion in a longlist for potential acquisitions or as a basis for removal from the list, without condemning the artistic quality.

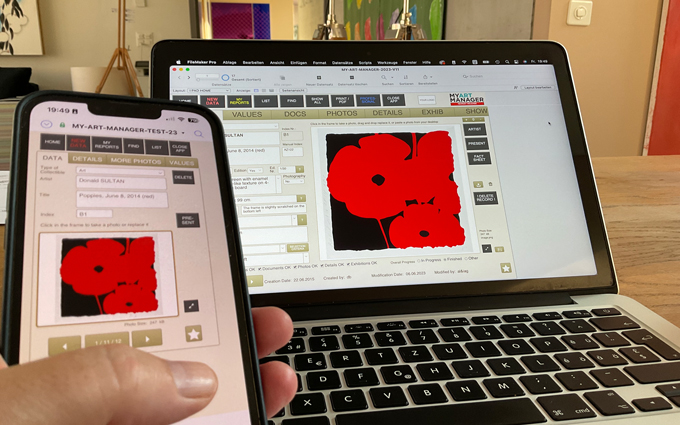

Dedicated app for inventory and management of artworks (Image: Art Leasing & Invest)

The company offers even more: With «Auction Leasing», clients are given the opportunity to participate in auctions, including at the Zurich based Koller, and finance up to 50 percent of a bid through the leasing model.

Interest from Banks and Law Firms

Thalmann and his expert team are also available for further consultations and evaluations of the artworks. The company developed an app named MY ART MANAGER, which simplifies the inventory of owned and leased masterpieces.

«More and more institutions, especially banks and law firms, are outsourcing tasks related to their art collections to us. We take over the management of the works, develop concepts, finance the acquisition, update the exhibitions, and organise events with art for client acquisition», Thalmann explains.

For Smaller Pockets

This type of art financing has the potential to fundamentally change the way artworks are acquired and enjoyed. It also allows smaller companies and individuals to venture into the world of art without having to invest large sums immediately.