When it comes down to it, most of our daily attention span is focused on the major banks. But it is the smaller, less known institutions that offer the most value, an economic study seen by finews.com maintains.

Who is the best in the land? The search for the top private bank in Switzerland is always a rather delicate matter. There are many reasons for that. For one, not all institutions release detailed, comparative figures. Indeed, the classical private banking sector, not facing the constant regime of compulsory market disclosure, remains relatively tight-lipped.

That poses the question as to what criteria are the most important in any kind of industry ranking. Last but not least, there is also the pesky matter that numbers can be well out of date by the time the results and the relevant analysis get published.

Tragic Finality

That last point becomes particularly clear in the newest «Wealth Management in Switzerland» study by the Zurich University of Applied Sciences (ZHAW). The report, which finews.com received exclusive access to, surveyed 67 institutions, although the total still has Credit Suisse as an independent entity even though it has since been swallowed up by rival UBS.

Still, in that context, it was remarkable that Credit Suisse had a female board representation of 58 percent, the highest among peers. But that couldn't stop its ultimate, tragic fate and the end of 167 years of history for what was once Switzerland's second-largest bank.

A Few Reservations

That is why such surveys have to be taken with a pinch of salt. In the same breath, however, they interest practically everyone connected to the industry, particularly as to who comes first.

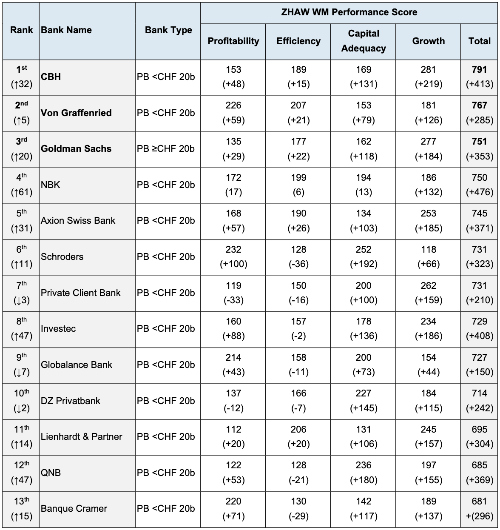

The study's experts take a closer look at 12 metrics in four different categories: profitability, efficiency, capital adequacy, and growth. The interesting thing here is that the leading banks in the ranking are the smaller ones, meaning there is no UBS, Julius Baer, or Zurich Cantonal Bank at the top.

Successful Niches

That leads one to think that smaller institutions do a better or more consequent job of executing their specific niche strategies, something that also impacts efficiency and profitability.

All in all, by that token, it is Geneva's relatively little-known CBH Compagnie Bancaire Helvétique that takes the top spot overall on the back of strong growth and capitalization. Bernese Privatbank Von Graffenried follows in second place, a smaller institution that sticks out thanks to its very high profitability.

US Investment Bank Makes the Grade

Surprisingly, Goldman Sachs takes third place. Even though it is predominantly a US-based investment bank, it has a highly efficient private banking arm in Switzerland, as the ranking (see table below) shows. It is also the only bank in the top ten that manages more than 20 billion francs in client assets.

(Click to enlarge)

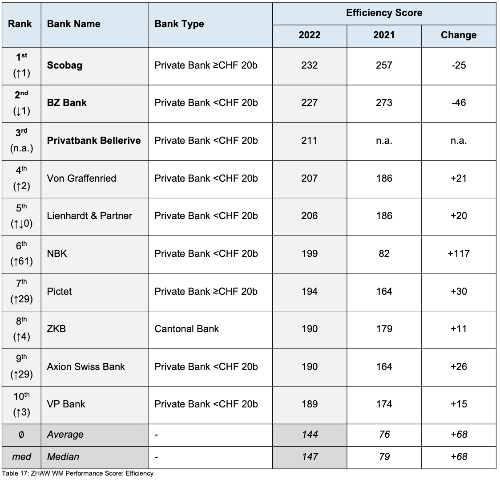

When it comes to profitability measured against capital adequacy, equity, and assets under management, a variety of different private banks make the top of the ranking. Their business is not all that capital intensive and at the same time they possess large levels of equity, something that matches the typical expectations of a high-net-worth clientele (see table below).

(Click to enlarge)

When it comes to efficiency, smaller banks also do better. Generally, better economics from a geographic presence outside the major Swiss financial centers, (Scobag in Basel, BZ Bank in Wilen, Schwyz) allows them to keep costs down. That and the fact that many are owned and controlled by parent institutions (Graubndner Cantonal Bank owns a majority of BZ Bank and Bellerive, a private bank) based outside of Zurich (see table below).

(Click to enlarge)

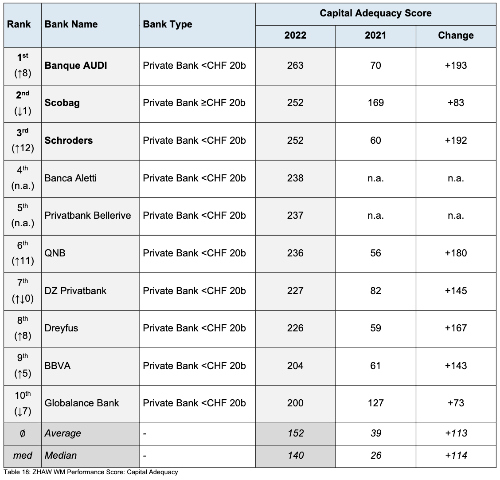

When it comes to capital adequacy, it is mostly the privately held institutions that make the grade. Because of their high levels of equity, they have above-average CET1, leverage, and liquidity coverage ratios. Moreover, partner-led banks have the luxury of holding more capital given they don't face external pressures to maximize resources by shareholders (see table below).

(Click to enlarge)

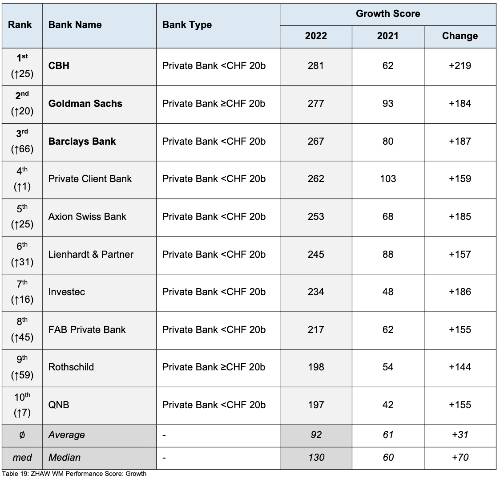

The study's authors also looked at bank sector growth rates set against more classical metrics such as net new money, and assets under management, comparing them with the number of employees at each institution. That gave a clear indication as to whether the growth was profitable or not (see table below).

(Click to enlarge)

The study also looked at the boards of directors of the 67 banks, finding that most have only about five or six members. That seems to indicate that the institutions seem to prefer leaner board structures.

Despite intensive efforts, women continue to be underrepresented at the board level, the study indicates. In about a third of all boards, there are still no women present and 74 percent of them have female representation of less than 30 percent.