In its sixth iteration, the «Responsible Investment Brand Index» assesses 600 asset managers worldwide for their dedication to responsible investing. Both UBS Asset Management and Pictet Asset Management, headquartered in Switzerland, secured positions in the coveted Top 10.

The «Responsible Investment Brand Index» (RIBI) serves as a reputable benchmark for evaluating asset managers' commitments to responsible investing. Released by financier Jean-François Hirschel and PR expert Markus Kramer, its latest edition, comparing 600 global asset managers, was unveiled on Tuesday.

For the first time, two Swiss entities have clinched spots in the top echelon: UBS Asset Management, under the stewardship of Aleksandar Ivanovic, secures third place, while Pictet Asset Management, led by chairman Laurent Ramsey, claims fifth. Notably, the Top 10 roster exclusively features European asset managers:

- DPAM

- CANDRIAM

- UBS Asset Management

- Nordea Asset Management

- Pictet Asset Management

- Amundi

- Wheb Asset Management

- Impax Asset Management

- Ecofi

- Robeco

Brand commitment

This index aims to spotlight asset management firms that actively embrace responsible investing and integrate it into their brand identity. It amalgamates quantitative metrics of tangible commitments with qualitative assessments of how deeply responsible investing is embedded in an institution's brand ethos.

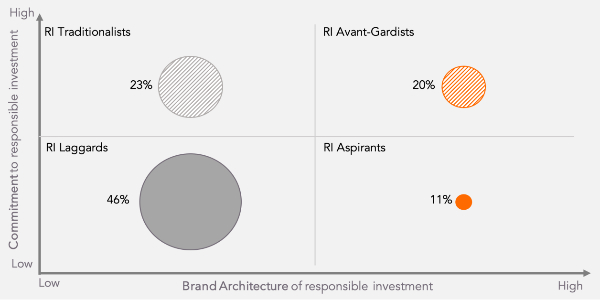

RIBI draws insights from the analysis of nearly 600 asset managers cataloged in the «Investment & Pensions Europe Journal Top 500», categorizing them into four segments.

Four categories of asset managers (Image: RIBI)

According to the report, the momentum toward responsible investing persisted in 2023, despite a challenging landscape: «We count 3 percent fewer Laggards than last year and 8 percent fewer than three years ago when RIBI first went global.» Over 50 companies have made strides to transition out of the Laggards category into one of the three more progressive segments.

UBS' and Pictet's Journey to the Pinnacle

The highest tier, «Avant-Gardists,» characterized by above-average commitments and brand ratings, is fiercely competitive, encompassing merely 20 percent of assessed asset managers. How did UBS Asset Management and Pictet Asset Management break into the elite Top 10?

In a conversation with finews.com, Hirschel explains that both firms consistently maintained «Avant-Gardists» status in previous years. However, given the intensifying competition, the authors opted to refine their criteria, particularly in the realm of brand commitment. This adjustment played to the advantage of the two Swiss institutions, as they had already deeply ingrained responsible investing within their brands.